Information available to Goldstreet Business indicates that nearly 500 employees of Unibank Ghana Limited have been served with dismissal letters.

Those affected include security personnel and tellers who were outsourced from, Top Recruitment, a company allegedly owned by Dr. Kwabena Duffour, founder of the bank.

Others include some contract workers, hired by the bank, to undertake various duties.

Our sources reveal the news of the expected layoffs have increased anxiety among permanent staff as they are unsure of their fate in the coming days.

Sources within the bank revealed that management of Top Recruitment will soon be served a letter of termination of contract while other contract workers have also received letters informing them that their one-year renewable contracts will not be renewed when it ends.

One of the permanent workers who spoke on condition of anonymity said “some of the permanent workers will be asked to do the work of the affected ones. Some of us will now become tellers and bulk tellers. As for the security, I don’t know how that will be catered for.”

It is unclear how much will be given to the affected workers as severance package.

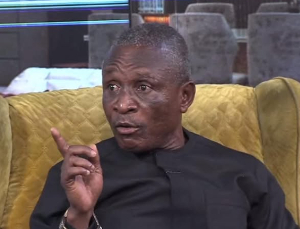

But in an interview to respond to the issue, Ato Sarpong a partner at KPMG denied that letters terminating the appointment of said staff have been issued but confirmed that some contracts are currently being reviewed and may either be renegotiated or terminated if deemed necessary.

“As we go along, if there is the need to do that in the interest of saving the bank, obviously we will make that decision, we have to first determine the prospects of the bank and what form it is going to take before you can tell what resources it will require” Sarpong explained.

He, however, revealed that three top managers have been asked to proceed on leave.

They include the head of IT, Deputy Managing Director and Head of Legal Affairs.

The Bank of Ghana (BoG) took over the management of the bank after declaring it distressed saying it has suffered liquidity shortfalls and breached its cash reserve requirement.

The Central Bank added that Unibank has depended on it for funds at various times since 2016 for its operations, which, at the time of issuing the report, totaled GHS2.2 billion.

BoG attributed the situation to weak supervisory standards and weak operations.

The Central Bank subsequently asked international audit firm, KPMG to take over the management of the bank to salvage the situation and prevent the bank from imminent collapse.

KPMG, the official administrator is to, among other things, ascertain the state of the bank’s assets and liabilities and exercise a variety of powers under the Banking Act 930 to rehabilitate and return the bank into regulatory compliance and viability within a period of six months.

The bank with 31 branches is expected to return to private ownership and management after the restructuring.

Business News of Thursday, 3 May 2018

Source: goldstreetbusiness.com