The African Union (AU) has endorsed President Nana Addo Dankwa Akufo-Addo’s proposal for mobile money interoperability across Africa.

The proposal considered a crucial step toward the continent’s economic integration, seeks to facilitate smooth economic transactions and increase intra-Africa trade and development.

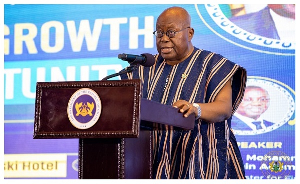

The AU Heads of State and Government made the decision after President Akufo-Addo presented two reports for consideration during the Union’s Sixth Mid-Year Coordination Meeting of Regional Economic Communities in Accra last weekend.

The recommendations in the two reports, “Establishment of the African Union Financial Institutions (AUFIs)” or “Scaling up Interoperability for Economic Integration: Using Mobile Money to Buy and Sell Across Africa,” were endorsed unanimously by the meeting. The meeting also endorsed that the reports be tabled for consideration by the 79th Session of the United Nations General Assembly later in September 2024.

The meeting was convened to assess the progress of the continental integration agenda and evaluate the efficiency of the harmonisation of policies between the AU and the regional economic communities.

President Akufo-Addo, who also serves as the AU’s Champion on African Union Financial Institutions, underlined during the meeting that mobile money interoperability would not only advance Africa’s integration ambition but would also improve the financial inclusion of its most disadvantaged populations.

He emphasized the transformative potential of mobile money interoperability, particularly for small-scale businesses and informal sector traders, who form the backbone of many African economies.

This will transform African business practices, provide jobs for young people, and boost economic activity, as the continent already accounts for over 70% of global mobile money transactions.

“By leveraging mobile money technology, we can break down barriers to trade and boost economic activities to empower millions of Africans in the continental and global economy.

"Our continent is home to a vibrant market of nearly 1.4 billion people, with the majority being the youth; what they call Generation Z, with the Alpha Generation in tow…It is in our collective interest as today’s leaders to offer the youth of our continent the freedom to express their creativity economically and without border constraints and earn from their enterprise.

“Give the youth of Africa the freedom to aspire, and they shall be inspired to lead in creating the Africa we want, the Africa we desire, and the Africa they deserve.

“Let us leave Accra knowing we have committed our union, our Regional Communities, and our Member States to allowing our people the opportunity to buy and sell anywhere in Africa, using just their hand-held mobile device. Let us leave this room committing all our relevant institutions to fast-tracking the process.

“By championing interoperability, we are taking a decisive step towards realising the Africa that our freedom fighters dreamed of, which today is in our hands to bring about—a prosperous, integrated, and globally competitive continent,” President Akufo-Addo said, and urged his counterparts to demonstrate the will and commitment required to enable the ambitious agenda work for Africa.

The AU has urged member states, regional economic communities, and other stakeholders to commit to achieve mobile money interoperability by 2027.

This includes integrating all member nations into the Pan-African Payment and Settlement System (PAPSS), enabling cross-border mobile money interoperability, and creating a continental regulatory framework for mobile money activities.

Africa’s mobile money transactions are estimated to be worth more than $1.26 trillion, accounting for almost 40 per cent of Africa’s GDP.

Financial inclusion in West Africa has increased dramatically due to mobile money, reaching 71 per cent and rising.

East Africa has a 73 per cent mobile money penetration rate, while Southern Africa is at 45 per cent and growing.

The adoption of mobile money interoperability represents a key step toward the African Union’s goal of building a single, unified market for Africa.

It is projected to boost economic growth, lower transaction costs, and improve continental economic integration.

Mohammed Cheikh El Ghazouani, Chairperson of the African Union and President of Mauritania, emphasised the importance of harmonising national and regional policies to advance socioeconomic development on the continent.

The mobile money interoperability agenda aligned with the AU’s goal of promoting economic stability and strengthened ties among member states.

Business News of Tuesday, 30 July 2024

Source: GNA