... petroleum product prices to go down

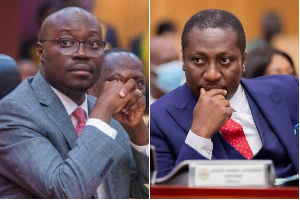

Accra, July 29, GNA - Parliament has given government the approval to abolish ad-valorem tax of 15 per cent on petroleum products. Government has subsequently introduced a specific excise tax, Mr Kwadwo Baah-Wiredu, Minister of Finance and Economic Planning told Parliament, when moving for the House's approval on Friday. He said the measure would reduce the ex-refinery prices of petroleum products.

Mr Baah-Wiredu said this was to lessen the burden of skyrocketing prices of crude oil on the world market on the Ghanaian citizenry. "Government has decided to take appropriate measures to stabilize the local market by rationalizing the taxes and the price build-up, which is the only option available," he said.

The price of petroleum product in the country is determined among other things by the price of crude oil; cost of refining the crude oil; government taxes and levies and various margins for dealers and marketers.

Meanwhile, the House had amended the debt recovery of (Tema Oil Refinery Company Fund Act 2003 (Act 642) to replace the schedule in order to reduce the levy on petroleum products.

According to the old schedule, premium, which had the levy of not exceeding 640 cedis per litre would now have a levy not exceeding 500 cedis per litre; kerosene levy has been slashed from 640 cedis per litre to 350 cedis per litre; while gas oil, whose levy was 640 cedis per litre had been reduced to 500 cedis per litre.

The rest are marine gas oil from 640 cedis per litre to 500 cedis per litre; residue fuel oil from 640 cedis per litre to 350 cedis per litre; liquefied petroleum gas (LPG) from 640 cedis per litre to 500 cedis per litre and lastly premix would go down from 640 cedis per kilogram to 500 cedis per kilogramme.

This would translate into the following prices as earlier announced by Mr Kwamena Bartels, Minister of Information and National Orientation: Petrol would sell at 40,000 cedis per gallon instead of the current 42,000 cedis per gallon; Kerosene from 34,000 cedis per gallon to 32,000 cedis per gallon; Gas oil from 38,000 cedis per gallon to 37,000 cedis per gallon and the price of LPG comes down from 110,000 cedis for 14 kilograms to 100,000 cedis.

Addressing the media on Friday, Mr Bartels said the Government in consultation with the National Petroleum Authority (NPA) had placed before Parliament a bill for the total abolition of the ad-valorem tax imposed under the Customs and Excise Duties and Other Taxes Amendment Act, 1998 and that would see reduction in the prices of petroleum products.

Various variations have also been made to the other duties and taxes that upon approval by Parliament would bring the new prices into effect.

He said the review was in consonance with Government's commitment made in the 2005 Budget statement, which made it clear that it would be reviewing these taxes from time to time.

Mr Bartels explained that when the 2006 Budget statement was read in November 2005, the price of crude oil stood at about 60 dollars per barrel - the figure used to plan the Budget for 2006.

"Today, crude oil prices are nearly 80 dollars per barrel and all expectations are that prices could rise to over 100 dollars per barrel."

Mr Bartels noted that since the announcement of new petroleum prices by the NPA on July 20, 2006 the Government through the Ministry of Finance had been working feverishly at what it considered necessary to mitigate the impact of the increase on the public as well as the economy.

He said the Government cared about the ordinary man and was determined to do all that it could to ensure that while the economy grew the living standard of the people also improved.

Mr Bartels said Parliament at the beginning of the November 2005 approved a budget where revenue from petroleum taxes was projected at 4.1 trillion cedis.

After the latest review, the revenue projected would have been 4.3 trillion, a difference of only 200 billion cedis.

He said in June 2006 the expected monthly adjustment to petroleum prices did not take place and this resulted in TOR under-recovering the cost of refining to the tune of 13 million dollars which the Government was obliged to pay to TOR.

Mr Bartels said the NPA was an independent authority set up to regulate prices of petroleum products and the Government was not about to reverse that policy by interfering in the NPA's de-regulation functions, nor is it about to take upon itself the right or obligation to fix petroleum prices.

Mr Bartels said the Government was, however, responsible for the fixing of duties and levies, which were critical inputs into the final ex-pump prices of petroleum products.

He said since the Government had reviewed the taxes that went into the petroleum price build-up and considering the reductions in taxes and levies, the effects would be felt by the people and the economy. Mr Bartels said revenue from taxes, including petroleum taxes, was what funded the nation's development.

"We are being forced to take the unwelcome decision to cut back on our development programmes in all sectors of our economy. "It is a very painful choice that we have to make, but as we said earlier, all indications are that the price of crude oil is not about to fall but rather is likely to increase.

"As a nation, we have to decide how far we are prepared to go in cutting down on taxes and consequently on our development. Even if we decided to slash all taxes on petroleum build-up and stopped investing in the development of our nation and the price of crude continued to rise, what would we do as a nation?"

He said the Government would like the entire nation to begin to debate the options, which were currently open to it in the face of rising crude oil prices on the world market in relation to development expectations.

Mr Bartels said for now, however, the Government had decided in the face of the unpredictability of prices of crude oil in the world market to cut down on investment in development.

"When petroleum prices globally are stable, normal management practices can apply.

"With the current global situation, however, Government believes that it would be unconscionable to maintain the ad valorem tax. Therefore, as of today, excise duty is now specific and ad valorem is no more."