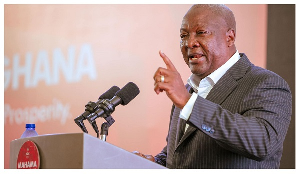

The Governor of the Bank of Ghana, Dr Ernest Addison, has said the central bank decided to revoke the licence of Heritage Bank recently because its majority shareholder, Mr Seidu Agongo, failed the "fit and proper person" test, thus, "unsuitable" to own or run a bank in Ghana.

Dr Addison told journalists on Friday, 4 January 2019 at a press conference that: “The bank’s capital appears to have come from sources which are suspicious”.

According to the Governor, “The promoters of Heritage provided evidence to the Bank of Ghana at the time of the application for a banking licence to the effect that an amount totalling GHS 120.6 million was lodged with a local bank.

“The amount of GHS 120 million was transferred to the bank from Agriculture (a company wholly-owned by Seidu Agongo, a promoter of Heritage), which funds appear to have been derived from contracts awarded to Mr Agongo by COCOBOD and are currently the basis of criminal prosecution in the High Court of Ghana. Meanwhile, it has come to the notice of the Bank of Ghana that the bank has yet to respond to two High Court orders for disclosures relating to these and other contracts affecting the significant shareholder Mr. Agongo.

“While Mr Agongo claimed that his sources of capital for the bank included proceeds of a USD 19.25 million contract with COCOBOD, Bank of Ghana’s subsequent investigations have shown that there was no such contract between COCOBOD and Mr Agongo. One or more contracts executed, however, existed between COCOBOD and Sarago Limited (“Sarago”). Documents submitted to the Bank of Ghana for licensing of the bank made no mention of the contract between COCOBOD and Sarago nor the fact that Sarago (also a shareholder of the bank) was owned by Mr Agongo”.

Mr Agongo is currently in court with the state over the COCOBOD saga based on which the central bank Governor revoked Heritage Bank’s licence.

The case, in which he and former COCOBOD CEO, Dr Stephen Opuni, are alleged to have fraudulently secured several contracts totalling GHS271 million to supply fertiliser to the Ghana Cocoa Board, is yet to be determined.

In March 2018, the Attorney General charged the two of them with 27 counts of willfully causing financial loss to the state.

It is the contention of the AG that Dr Opuni, during his tenure as COCOBOD CEO (November 2013 to January 2017), breached laid-down procedures in procurement and other laws that led the state to lose GHS271.3 million in the alleged fertiliser scandal and the distribution of substandard fertiliser to cocoa farmers.

The two accused persons have denied any wrongdoing and have pleaded not guilty to all the 27 charges and have each been granted a GHS300,000.00 self-recognisance bail by the court.

Asked by journalists if the action of the central bank was not premature, since the COCOBOD case was still in court, Dr Addison responded thus: “The issue of Heritage Bank, I wanted to get into the law with you, I don’t know if I should, but we don’t need the court’s decision to take the decisions that we have taken. We have to be sure of the sources of capital to license a bank, if we have any doubt, if we feel that it’s suspicious, just on the basis of that, we find that that is not acceptable as capital. We don’t need the court to decide for us whether anybody is fit and proper, just being involved in a case that involves a criminal procedure makes you not fit and proper.

Read below the full details of the reasons based on which the central bank revoked Heritage Bank’s licence:

Heritage Bank Limited (Heritage) was incorporated on 31 January 2014 and was licensed by the Bank of Ghana as a universal bank on 4 October 2016. The promoters/shareholders of the bank were specified as Mr Seidu Agongo, Ms Fatima Adamu, Sarago Limited, and Mr Sylvanus Kotey, who, together purportedly met the minimum paid-up capital of GHS 120 million.

As part of its efforts to clean up the banking sector, the Bank of Ghana has recently examined the affairs of Heritage and discovered a number of anomalies relating to its licensing, the sources of its capital, and related party transactions.

The Bank of Ghana has consequently revoked the licence of Heritage Bank. Under section 16 (1) (a) (7) and (8) of Act 930, the Bank of Ghana may revoke a licence and appoint a receiver under section 123 of the Act where it is satisfied that an applicant provided false, misleading or inaccurate information in connection with the application for a licence or suppressed material information, and may, in cases of emergency, or in the public interest, revoke the licence of the bank without notice. Further, sections 9 and 12 of Act 930 authorise the Bank of Ghana to revoke a licence if it considers that significant shareholders of a bank are not suitable.

The grounds for revocation of the licence are as follows:

The bank’s capital appears to have come from sources which are suspicious. In the application for a banking licence, each shareholder of Heritage needed to demonstrate their “ability to subscribe to the shares” of the bank. The Bank of Ghana is not satisfied that the original sources of the bank’s capital are acceptable, in terms of section 9 (d) of the Banks and SDI Act, 2016 (Act 930) and section 1 of the Anti-Money Laundering Act of 2008 (Act 749), which requires acceptable capital to be obtained from lawful and transparent sources. Specifically:

The promoters of Heritage provided evidence to Bank of Ghana at the time of the application for a banking licence to the effect that an amount totalling GHS 120.6 million was lodged with a local bank. The amount of GHS 120 million was transferred to the bank from Agricult (a company wholly-owned by Seidu Agongo, a promoter of Heritage), which funds appear to have been derived from contracts awarded to Mr Agongo by COCOBOD and are currently the basis of criminal prosecution in the High Court of Ghana. Meanwhile, it has come to the notice of the Bank of Ghana that the bank has yet to respond to two High Court orders for disclosures relating to these and other contracts affecting the significant shareholder Mr Agongo.

While Mr Agongo claimed that his sources of capital for the bank included proceeds of a USD 19.25m contract with COCOBOD, Bank of Ghana’s subsequent investigations have shown that there was no such contract between COCOBOD and Mr Agongo. One or more contracts executed, however, existed between COCOBOD and Sarago Limited (“Sarago”). Documents submitted to the Bank of Ghana for licensing of the bank made no mention of the contract between COCOBOD and Sarago nor the fact that Sarago (also a shareholder of the bank) was owned by Mr Agongo.

From its 2017 audited financial statements, an amount of GHS15.8m was transferred to the bank from an unnamed investor, which was attributed to unpaid called-up share capital, calling into question whether the minimum capital of the bank had been fully paid up at the time of licensing. From the same financial statements, an operating loss was booked resulting in a shortfall of GHS 20.6 m in the bank’s capitalisation. This was expected to be repaid by an unnamed shareholder through a transfer of fixed assets (branches) to the bank. Despite attempts by the Bank of Ghana to confirm (i) the identity of the unnamed shareholder, (ii) the basis of valuation of the fixed assets, and (ii) whether the terms of the transactions were at arms’ length, and, otherwise acceptable, the bank and its shareholders, directors, and management have failed to clarify matters.

Certain shares of the bank were held by nominee shareholders whose ultimate beneficial shareholders were not disclosed to the Bank of Ghana. The shareholder on record for Sarago is one Ruth Leena Abazerri, although the Bank of Ghana has reasonable grounds to believe that it is owned by Seidu Agongo. This is in breach of section 9 of the Anti-Money Laundering Act, which requires the disclosure of beneficial ownership of shares, as well as regulation 9 of the Anti-Money Laundering Regulations (L.I. 1987) which require that beneficial owners are not fictitious.

Several related party transactions were entered into between the bank and entities owned or controlled by its significant shareholder Mr Agongo such as Sassh Alliance, Moor Company Limited, and Kedge Company Limited, on terms and conditions that remain unclear and/or not transparent.

The Bank of Ghana has determined, pursuant to sections 9 and 12 of Act 930, that the majority shareholder of the bank, Mr Agongo, does not meet the “fit and proper person” test.

The bank failed to meet the GHC 400 million capital required as of 31st December 2018.

Business News of Monday, 7 January 2019

Source: classfmonline.com