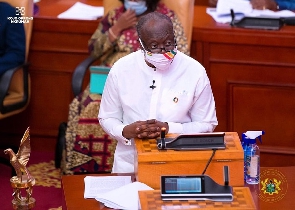

Finance Minister Ken Ofori-Atta says the Agyapa Royalties deal offers the country a rare opportunity to make the most out of its mineral resources.

The Minister, speaking at a press conference in Accra on Thursday, justified the deal, which seeks to monetise the country’s future royalties from some 16 mining concessions via an equity fund raising on the London and Ghana stock exchanges, using Agyapa Royalties, a special purpose vehicle.

While the move has drawn the angst of civil society groups and opposition parliamentarians, Mr. Ofori-Atta argued that, historically, the country has not been able to maximise the value of its mineral resources, with the latest move providing an avenue to leverage high gold prices for development.

“We are very confident that this is the way to go,” said Mr. Ofori-Atta of the deal. “We have seen how foreign companies benefit from our resources and we just sit staring at them. I think it is time to reimagine the future and put a stamp on the understanding that these things are ours and we are going to get the best out of them.”

Among the concerns raised by some 15 civil society groups earlier this week on the deal was the fact that Agyapa Royalties, which is wholly owned by the state, is registered in Jersey, a tax haven.

They argued that government’s action endorses the use of tax havens to avoid taxes.

But the Finance Minister responded that the decision to incorporate Agyapa Royalties in Jersey was a strategic move to allow the country reap the most from the transaction.

“The world consists of all sorts of structures to be able to generate resources. If I therefore need to go to the London Stock Exchange, why [should] my company be taxed twice? It is not an issue of doing something wrong.”

The Finance Minister bemoaned the civil society groups’ description of the deal as a case of “elite capture”, describing it as unfortunate. He, nevertheless, said government is still open to engaging stakeholders and ensuring that it sees the deal over the line.

Regarding the allegations made by the groups that persons behind the deal may be politically exposed persons with affiliations to key persons at the presidency, the Deputy Finance Minister, Charles Adu Boahen, stated that the stringent listing requirements of the London Stock Exchange make it impossible for such a situation to arise.

Agyapa Deal

Agyapa Royalties Limited, a special purpose vehicle created by the Minerals Income Investment Fund (MIIF), will offer some of the shares held by the fund to investors in order to raise about US$500m when it lists on the Ghana and London stock exchanges before the end of the year.

Mr. Adu Boahen said the upfront capital to be raised from the listing, as well as regular dividends thereafter, will be invested in developing the country’s gold resources, and in building gold refineries and a world-class gold certification institution.

Click to view details

Business News of Friday, 28 August 2020

Source: thebusiness24online.net