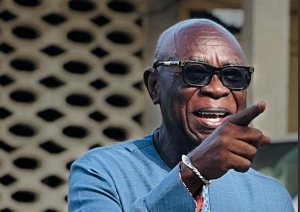

The Minister-designate for Trade and Industry, Alan John Kwadwo Kyeremanteng, has promised the business community a favourable business environment largely driven by access to affordable capital that will help them grow and expand.

When asked by a member of the vetting committee of parliament what he will do to help the growth and competitiveness of the private sector, Mr. Kyeremanteng said: “Facilitating access to medium to long term capital will be our focus to make industries competitive. We all recognise that it is not as if the banks do not provide access to capital, but it is the tenure of the credit they provide which is a challenge to industries.

It is in this regard that we have made a number of commitments. First, we will refocus the operations of the National Investment Bank to provide medium to long term credit.”

The Trade Minister-designate further stated that government will see to it that the National Industrial Fund, outlined in the country’s industrial policy which was launched in 2011, is rolled out to augment the private sector’s access to capital.

Another major issue that was criticised by industrialists and financial experts about the erstwhile Mahama-led administration was government’s high appetite for domestic borrowing which, they argue, resulted in high interest rates, thereby, crowding out a lot of businesses.

The country’s policy rate, which is the indicative rate at which central bank lends to commercial banks, is currently pegged at 25.5 percent, thereby, pushing banks to lend at around 35 percent.

Mr. Kyeremanteng said the NPP administration will address this situation by reducing its domestic borrowing in order to make more funds available for businesses.

“We will make sure that the government limits its borrowing from the financial sector. Once you do that, the banks have literally no option than to lend to businesses.

If we reduce the treasury bill rates, then it reduces the appetite of banks to lend to government and that will release more funds to the private sector,” he said.

Mr. Keremanteng further commented on interventions that will be specifically tailored to the growth and development of micro and small businesses, a sector which constitutes over 90 percent of businesses registered in the country, and contributing over 40 percent to GDP.

“To support the SMEs, we will reduce the cost of doing business in the country, and that includes reducing the taxes and levies imposed on them.

We will reduce the 17.5 percent VAT to 3 percent for micro and small enterprises. There is a whole cocktail of duties and levies that will be addressed to help micro and small businesses.

We will also recapitalise and refocus the MASLOC programme in order to help start-ups have access to capital,” Mr. Kyeremanteng said.

Business News of Wednesday, 25 January 2017

Source: B&FT

Alan Kyeremanteng assures businesses of more access to capital

Entertainment