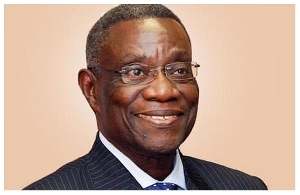

The long-term solution to Ghana’s foreign exchange challenges is to boost exports, expand ports infrastructure and increase trade efficiency, as well as attract more investment, including from the country’s Diaspora, says Alhassan Andani, Chief Executive of Stanbic Bank Ghana.

“We need to generate productive forex, not interest rate-dependent forex,” he said, adding that the recent scarcity of dollars and its impact on the value of the cedi -- a 3.1 percent depreciation in January, on top of 18 percent in 2013 -- means the country must invest in the future diversification of the economy as a long-term solution.

“For me, we should increase productive capacity and spend in areas where there is additional opportunity to increase revenue flows. For example, Ghana has a unique opportunity for becoming the warehouse of West Africa. If we invest in the ports so they can take any number of vessels and improve efficiency of handling, then everybody who wants to import into West Africa will pass through here, generating more inflows.”

He added that solutions such as using the central bank’s international reserves to support the cedi or raising interest rates are temporary and cannot be sustained.

“The cedi’s fall should be seen as an opportunity to generate more forex in future. Every airline wants to fly to Accra. What do we do? We should provide the facilities and charge them for it. That is an annuity income. If you invest in these areas, annuity income comes over 20 or 30 years.”

MPC meeting

On Monday the Bank of Ghana said it will hold its monetary-policy meeting today, two weeks earlier than planned, and announce a decision on Thursday. The move is seen as being motivated by the recent steep decline of the cedi, with the central bank expected to introduce additional administrative measures to fine-tune the foreign-exchange market.

One central banker hinted last week that the monetary authorities may limit the number of forex accounts that non-traders can maintain with a bank, an idea apparently intended to curtail the hoarding of dollars.

Already, in a bid to promote transparent pricing of foreign exchange and bring the market into greater exchange-rate harmony, the regulator has instructed banks to quote both their “buy” and “sell” positions when dealing with counterparties, and to limit the spread between the rates to 25 basis points in inter-bank transactions and 200 basis points in transactions with customers.

The BoG could also raise interest rates to increase the returns on cedi assets, even though this could further slow already lacklustre growth that registered 4.1 percent in the first nine months of 2013, compared to 8.7 percent in the same period of 2012.

Business News of Wednesday, 5 February 2014

Source: B&FT

Andani’s long-term view on cedi