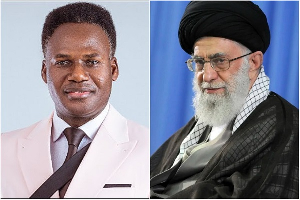

Government must ensure the automation of all domestic revenue mobilisation streams to help achieve revenue targets, says Professor Peter Quartey, the Head of Economics Department, Institute of Statistical, Social and Economic Research (ISSER), University of Ghana.

He said ensuring efficiency in tax collation through digitisation and limiting human interface or discretion was the surest way to avoiding corruption.

Prof Quartey was speaking at the Ghana National Chamber of Commerce and Industries’ (GNCCI) Virtual Seminar in Accra.

It was organised in partnership with KPMG, JoyBusiness, Bank of Africa, McDan Group, GhanaWeb, and Business24 on the 2021 Budget Statement on the theme: “2021 National Budget: Prospects for Recovery, Resilience and Competitiveness for Private Sector Growth.”

Prof Quartey said road toll, for instance, needed to be increased and automated because tax efficiency was very critical in national development.

He said there was the need to embrace taxes because it brought some amount of benefit to businesses and the public.

Speaking on the macroeconomic performance and its implications for the businesses environment, he said fiscal policy would impact the level of general economic activity, productivity, and job creation; both demand and supply of labour and livelihoods.

The Economic Professor said COVID-19 had worsened the already limited fiscal space and that expenditures and reliefs would certainly have to be paid, “there is no free lunch.”

“We need to broaden and widen the tax base to include a lot more people for national development,” he said.

Mr Evans Asare, the Senior Associate at KPMG, said government’s GhanaCARES Programme had the potential to drive the economic agenda over the next three years in developing the machine tool industry, the ICT/digital economy, supporting commercial farming, and attracting educated youth into agriculture.

He said the programme would drive the agenda of building Ghana’s light manufacturing, targeting agro-processing and food import substitution, developing the housing and construction industry.

It would also help the national mortgage and promote Ghana as a regional hub for financial services for manufacturing, ports and logistics.

Mr Asare mentioned initiatives in the budget to support businesses and revitalise the economy, which included access to finance, institutional reforms, the Public-Private Partnership Act, Vaccination and the AfCFTA Agreement.

Speaking on Taxation; Strategies to boost business growth and value for the private sector, he said the AfCFTA would be a game-changer in the coming days.

He said the intra-Africa export and imports would increase by over 80 per cent and 100 per cent respectively in 2035, which was currently estimated to be less than 70 billion dollars.

Mr Clement Osei-Amoako, the President of GNCCI, said this year’s national budget was unique because it came on the back of a global pandemic that disrupted every aspect of human life and business activities, adding: “It thus creates an implicit bias for measured expectations.”

He said the business reaction to the 2021 National Budget had been mixed on accounts of introduction of new taxes, upward revision of existing taxes, and COVID-19 support initiatives.

The seminar was, therefore, to allow experts and business operators to appreciate and interrogate government policies and programmes in the budget and explore inherent risks and business opportunities, Mr Osei-Amoako said.

He assured stakeholders of the Chamber’s firm resolve in promoting and protecting commercial and industrial interests in the country.

“I encourage non-members to register with the Chamber to start benefiting from the myriad of business opportunities and insight through the delivery of value-adding products,” he said.

Business News of Thursday, 18 March 2021

Source: GNA