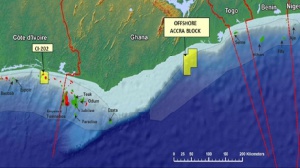

Following the exit from the block of other partners in March 2014 Azonto’s subsidiary Azonto Petroleum (Ghana) Limited, in which Vitol E&P Limited has a 43 per cent interest, and the other remaining partner Afex Oil (Ghana) Limited, secured a six-month extension of the licence to 23 September 2014 for the purpose of determining whether suitable operating partners could be found to proceed with into the next phase of Exploration under the Petroleum Agreement.

During the extension period, the company undertook extensive technical work, including further detailed evaluation of the seismic data and remapping, and set up a detailed data room which was visited by over ten companies.

However, as a result of the currently challenging market conditions, a farm-out agreement could not be finalised and the joint-venture partners have therefore elected not to seek a further extension of the Initial Exploration Period, nor to apply to enter into the First Extension Period under the Petroleum Agreement.

“Today’s announcement is another step in support of our strategy to focus on delivering value from our core asset in Cote d’Ivoire and prudently managing our balance sheet,” said Gregory Stoupnitzky, Azonto's managing director. “Relinquishing the Offshore Accra Block will reduce Azonto’s annual operating costs by up to USD 500,000, which is in line with our commitment to reduce G&A whilst focusing on the delivery of our development project in Côte d’Ivoire. We look forward to working with our CI-202 partners towards delivering and unlocking full value for shareholders.”

As a consequence, the joint-venture partners have formally advised the Ghana Ministry of Energy and Petroleum that all of the contract area is relinquished and that Azonto Petroleum (Ghana) Limited has withdrawn as temporary operator in respect of the licence.

There were no outstanding commitments under the work programme, which was completed in the period to 31 December 2013, and there is no cost to the company associated with the relinquishment.

Business News of Wednesday, 11 March 2015

Source: oilandgastechnology.net