The Ministry of Finance has released GH¢700million as the first tranche of a GH¢1.5billion bailout package for investors affected by the collapse of asset management companies (AMCs), which was announced during the 2024 mid-year budget review.

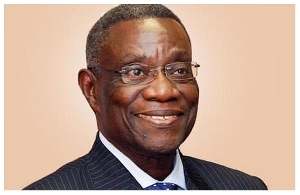

Finance Minister Dr. Mohammed Amin Adam made this public during the August 2024 Monthly Press Briefing on the Economy.

It marks a crucial step in government’s efforts to restore confidence in the financial sector. The funds are aimed at providing relief to thousands of investors whose funds have been locked up in defunct fund management companies since the financial sector clean-up began in 2017.

Dr. Adam indicated that intervention is being done despite the country’s tight fiscal space, and is evidence of government’s commitment to provide relief for investors in the defunct AMCs, particularly pensioners.

According to the Finance Minister, the GH¢1.5billion package will be released in three tranches – with the first GH¢700million already processed for release through the Controller and Accountant-General.

This initial disbursement is expected to significantly increase the number of fully-settled investors under the bailout scheme.

In total, government expects this latest intervention to bring the number of fully settled investors to 94,165 – representing 90 percent of the total 105,178 validated claims.

Although some might argue “better late than never”, the delay has caused considerable hardship for many investors; particularly retirees who relied on these funds for their daily sustenance.

Hence, the announcement has been met with cautious optimism in financial circles. To government’s credit, successfully implementing this bailout could play a crucial role in restoring trust in the financial system and attracting both domestic and foreign investments.

However, several bank depositors (savings and loans, microfinance and discount houses) whose claims were certified by the receiver in 2019 and 2020 have yet to be reimbursed.

Analysts also point to inconsistencies in government’s communication regarding the bailout programme. For instance, what is the cost of government’s clean-up of the banking system? This is because estimates range from GH¢21billion to GH¢25billion!

Dr. Amin Adam explained that the payment process was captured in the 2024 Mid-Year Review of Fiscal Policy presented in July 2024, when the Cabinet granted approval for the disbursement.

That notwithstanding, the MoF maintains that the bailout package’s remaining tranches will be released in due course – with the timeline to be communicated in subsequent briefings.

Business News of Monday, 2 September 2024

Source: thebftonline.com