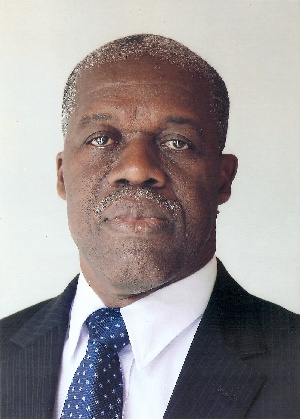

Paa Kwesi Amissah Arthur, Governor of the Bank of Ghana, has hinted that there are plans to push more US dollars into the economy as a means to stabilize the cedi, which has been on a free fall.

The governor, who observed that there had been a substantial liquidity overhand which was finding its way to foreign exchange, said the central bank intended to use its foreign exchange reserve to ensure that the cedi was stabilized.

On what he described as a “market reaction to a market situation”, Mr Amissah Arthur said while the nation battled the uncertainties, “we still have substantial reserves we intend to stabilize the cedi and after we have to go back into the market and buy back the dollar and put in our reserve”.

To avert the situation, the governor was sure the best move was to take the liquidity out by reducing the demand for foreign exchange.

“That is why we have accumulated the reserves over the years. So we apply the reserved to the problem as we see it.”

He insisted that the recent depreciation of the cedi was not a hopeless situation as measures had been taken to save the cedi from declining further.

Analysts have been worried over the free fall of the cedi against some major international trading currencies such as the US dollar, and have noted that the trend could not been changed with monetary policies.

“The situation is not hopeless at all. We have analyzed the exchange rate development over the last month and our conclusion is that the economic fundamentals are solid,” said Mr Amissah Arthur at a press briefing to share major decisions taken by the Monetary Policy Committee at its 50th session.

“If we have growth of 14, 15 and 16 percent a year, adjusting your import requirement to the higher growth would result in some imbalances as we have to adjust to higher threshold. It would take some time to adjust our needs to the requirement but we consider this to be a temporary development,” he further explained.

He noted that that further depreciation of the cedi would lead to a resurgence of inflation and “we want to stem it. That is why we have taken these decisions”.

The cedi has since the last quarter of 2011 weakened against the US dollar in the foreign exchange market and this has accentuated uncertainties and risked the growth of the economy, but Mr Amissah Arthur said there were plans to institute a number of measures to reverse the dollarisation of the economy.

He said immediate measures taken included increasing the policy rates by one percent. This means the policy rate has been moved from 13.5 percent to 14.5 percent.

To improve the supply of foreign exchange by banks to the market, the single currency Net Open Position (NOP) of banks have also been reduced from 15 percent to 10 percent, while the aggregate Net Open Position will also drop from 30 percent to 20 percent.

He explained that the depreciation of the cedi was driven by a growing demand for foreign exchange to support increased economic activity due to the expansion of the economy.

Others included changes in the trade patterns, which is shifting towards Asia, especially China, in which transactions are mostly conducted on cash basis and external sector conditions such as the Euro zone crisis, as well as speculative activities by foreign exchange traders.

In addition to strengthening controls to reverse depreciation of the cedi, the governor said the bank would “also be monitoring development closely and will not hesitate to take additional measures if deemed necessary”.

Business News of Friday, 20 April 2012

Source: Daily Guide