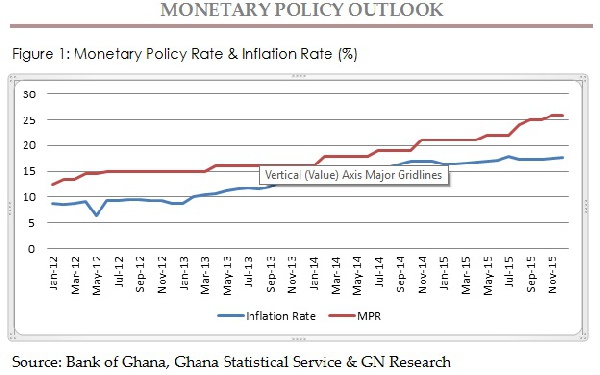

The Monetary Policy Committee (MPC) of the central bank is set to review the Monetary Policy Rate (MPR), on Monday, January 25, 2016, with the overriding objective of ensuring stability in prices and low inflation to minimise depreciation in the cedi and support output and employment growth.

In 2015, monetary policy rate was increased from 21% at year-open to 26% during the last MPC meeting amid the many concerns raised by the business community about the imminent devastating effects on the domestic economy. However, the end-year consumer price inflation for 2015 stood at 17.7% as against 17.0% recorded at the close of 2014.

The notable reasons acknowledged by the central bank were irrepressible fall in world commodity prices, high energy costs associated with the power crisis, fear of capital outflows in anticipation of an increase in US key policy rate, quarterly adjustment in utility tariffs and the pass-through effect of the cedi depreciation.

At the global level, low commodity prices, slowdown in China and devaluation of the Chinese yuan that impacted negatively on most currencies and output growth of developing countries including Ghana in 2015, is expected to continue in 2016.

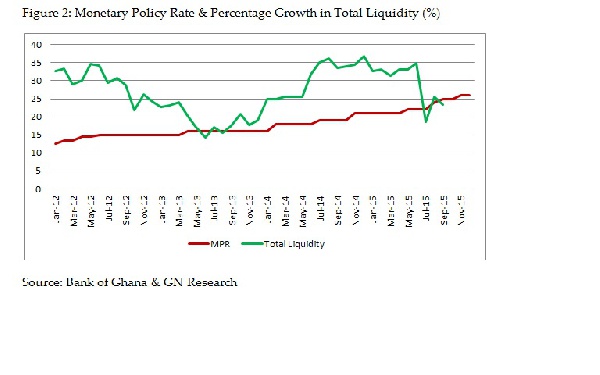

On the domestic market, recent statistics published by the BOG indicates that growth in total liquidity declined to 23.3% in September 2015, marking a slowdown from 33.6% recorded by the same time in 2014. However, the recent uptick in cedi depreciation may be a reflection of declining reserves at the central bank and signal upside risks in the immediate future.

Coupled with the recent hikes in utility tariffs, upward review in petroleum taxes and the IMFs position on further tightening in monetary policy stance, it is very evident that the MPC will vote for an increase in monetary policy rate, come Monday, January 25, 2016.

See the chart below:

Business News of Friday, 22 January 2016

Source: GN Bank