Bank of Ghana kept its benchmark interest rate unchanged at 20 percent on Monday, citing the need to keep inflation within its medium-term target of 8 percent plus or minus two percentage points.

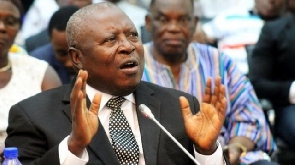

Governor of the Bank, Dr Ernest Addison told a news conference that while inflation expectations appeared to be well anchored, there were some emerging pressures underlying inflation in the last two months of 2017.

“Under the circumstances and to ensure that the inflation target horizon is maintained and the medium term inflation target of 8 percent plus or minus two percentage points is achieved this year, the Committee decided to maintain the monetary policy rate at 20 percent,” he said.

The Central bank has eased rates by 550 basis points in the past year to foster growth on the back of decline in headline and core inflation throughout 2017.

Dr Addison said provisional data on government operations indicated an overall budget deficit of 5.4 percent of Gross Domestic Product (GDP) in the year to November 2017, against the target of 6.0 percent.

Total revenue and grants was 17.1 percent of GDP, below the target of 19.0 percent while of GDP below the budgeted estimate of 25.0 percent.

“Preliminary banking data showing government receipts and payments indicate that the overall budget deficit is likely to stay within the 2017 target of 6.3 percent of GDP,” he said.

Total public debt as at November 2017 stood at GH¢138.8 billion (68.7 percent of GDP) up from GH¢122.6 billion (73.3 percent of GDP) in December 2016.

Domestic debt component went up by 20.1 percent to GH¢64.2 billion, while external debt rose by 7.9 percent to GH¢74.7 billion.

On the external front, Dr Addison said the trade account recorded a surplus of $1.1 billion compared with a trade deficit of $1.8 billion in December 2016, and driven mainly by higher export receipts from oil, cocoa and gold.

Gross International Reserves stood at $7.6 billion, equivalent to 4.3 months of import cover compared to $6.2 billion in December 2016.

Click to view details

Business News of Monday, 22 January 2018

Source: ghananewsagency.org