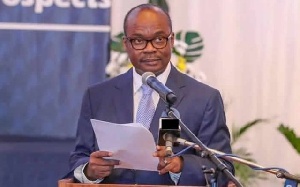

Banks in the country must scale-up their support for the private sector, considering the gains of ongoing reforms in the sector and restoration of macroeconomic stability, Dr. Ernest Addison, Governor of the Bank of Ghana, has said

Addressing a gathering of bankers at the 2018 Annual Bankers’ Dinner in Accra, he indicated that the numerous reforms ongoing in the banking industry are aimed at positioning it to better serve the fast-growing economy.

“The gains achieved in macroeconomic stability, together with the implementation of other policy initiatives, will provide some impetus to economic growth. Banks, therefore, must position themselves to scale-up their support for private sector-led growth.

“The restoration of macroeconomic stability should provide some basis for improved financial intermediation to boost economic activities in the near-term,” he said.

Dr. Addison said the banking sector is one of the key pillars essential to realisation of the high aspirations for developing the Ghanaian people – hence the need for solid, strong and well-capitalised banks to support that cause.

“The sustainability of the banking industry is critical to achieving the high aspirations of Ghanaians. As such, all stakeholders must work to ensure that banks operate within an enabling environment that supports them to carry out their financial intermediation function,” he added.

The BoG boss said it is the collective responsibility of sector actors to ensure efficient financial intermediation in the economy to help address some of the confidence issues which have arisen in the wake of the clean-up.

“We should collectively work hard to regain the general public’s confidence through the introduction of prudent policies, regulations and procedures to ensure the irreversibility of reforms introduced.”

The Annual Bankers’ Dinner of the Chartered Institute of Bankers (CIB) is the last activity on their calendar in honour of the Governor of the BoG.

It was an occasion for bankers and industry stakeholders to interact with the central bank head and gain key insights into prospects for the year ahead, including key policies and their implications for the banking fraternity.

The CIB President, Rev. (Mrs.) Patricia Sappor, applauded the central bank for the bold reforms that it has churned out to help stabilise, clean up and restore public confidence in the banking sector.

In highlighting the need for improved customer service delivery in the sector, she proposed: “It is the view of the CIB that the central bank sets a minimum customer level standard for banks in the area of customer service to ensure standard and quality service across the board”.

Rev. Sappor called on the sector regulator and stakeholders alike to increase financial literacy awareness in the wake of recent happenings in the sector.

“How the average Ghanaian can place their hard-earned money with financial institutions, in a country where the illiteracy rate is quite high, relies heavily on direction from the central bank to enable them to make prudent decisions,” she said.

Business News of Wednesday, 5 December 2018

Source: classfmonline.com