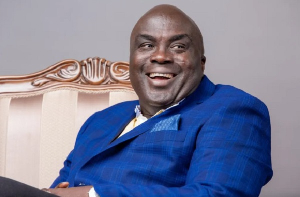

The Head of Retail Banking at FBN Bank, Allen Quaye, has indicated that banks are taking the necessary steps to manage risks while continuing to lend and support economic growth.

In an interview following the 10th Quarterly Banking Roundtable held by the UPSA Law School, Mr. Quaye explained that the banking sector has implemented stricter risk management policies and frameworks to minimise toxic assets in their books following recent challenges.

“We’ve looked at our risk criteria framework, which is more or less to evaluate our credit risk applications and see which ones are where these two ports are not,” he stated.

Banks have also increased their holdings of lower-risk government securities. He stressed that banks aim to balance managing risk while still serving customer needs.

At the same time, Mr. Quaye emphasised that banks are focused on recovering non-performing loans and restructuring facilities for viable but struggling borrowers.

“We are on serious drive to recover them to reduce or reduce the cost of toxic assets,” he remarked. The decline in interest rates is also helping some borrowers manage loan repayment.

Banks are collaborating with regulators and policy-makers as well to strengthen cyber-security defenses and support the push toward a more cash-lite economy. “All those risks associated with the cash heavy economy is borne by banks,” Mr. Quaye commented.

While recognising that the tighter credit risk controls have contributed to a squeeze in lending, Mr. Quaye affirmed: “We still believe that through that lending activity, we will still make good money as a bank”. He reiterated that banks will keep supporting creditworthy borrowers as much as possible.

“It’s good but it will take a while to eventually translate onto the cost of funds,” Mr. Quaye said regarding the positive real interest rate environment. He noted banks may still have higher cost legacy deposits and cannot unilaterally reduce rates paid to customers.

Watch the latest edition of BizHeadlines below:

Click here to follow the GhanaWeb Business WhatsApp channel

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Click to view details

Business News of Sunday, 31 December 2023

Source: thebftonline.com