Vice President Dr Mahamudu Bawumia on Tuesday explained that Ghana’s debt stock is not increasing despite a series of borrowing which as computed by Citi FM’s Bernard Avle hits close to GHS40billion.

At Tuesday’s encounter between President Nana Akufo-Addo and the media, the Citi Breakfast Show host threw the following question to the government

Good afternoon, my name is Bernard Avle, I work at Citi FM. Mr President, I remember during the campaign, yourself and the Vice President expressed worry about the level of debt that Ghana was incurring and among other things you said that because of the mismanagement we were having to borrow and then we have enough internal resources and therefore we should block the loopholes.

Permit me to give you some figures. In March this year we went for Ghc1billion 3-year bond. In April a $2.25billion dollar bond which translates into Ghc10.25 was announced. In the same month, we announced a $2.4million bond to clear legacy debts in the energy sector, translates that to Ghc12billion.

Last week we were told there is a Ghc17.4billion bond being sought for T3.

Putting all the figures together in Ghana cedis, that’s about Ghc40billion if all these bonds go through.

The last time I checked our GDP was about Ghc80billion. If within the first quarter of the first year we are already borrowing up to half of our GDP, where are the internal resources? How much resources have you generated internally? Why are we still borrowing this much? Thank you.

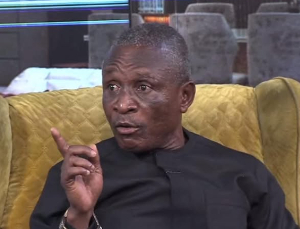

Here was Dr Bawumia’s answer:

Thank you very much. Bernard asked a question about the debt and how it appears to be increasing. I think we have to go back a little bit. You saw that last year the deficit was 9.4 per cent of GDP. That’s where it ended and thanks to the Asempa budget, we’ve gone back on the path of fiscal consolidation to bring back the deficit this year to 6.5per cent of GDP.

Now in doing so, you are going to be bringing down the debt stock in the process. I will also let you know that in the last 4years between 2012 and 2016, the debt stock went up from 45 per cent of GDP to 72 per cent of GDP. That means on average, every year the government was adding 6.75 per cent of GDP to the debt stock.

Now the GDP is not Ghc80billion as you quote but closer to Ghc200billion this year. And we are going to end the year, after inheriting about 72 per cent of GDP, we are hoping to bring it down slightly between 70 and 71 per cent of GDP. So we are looking at how we manage the finances to bring down the debt burden.

So even if you are borrowing, the burden of that, we are trying to bring down through the process of consolidation. The Finance Minister is here, he is keeping all of us in line. What happened before with this unbridled borrowing, you find out that we owe so many contractors who have not been paid and so on.

Today the GIFMIS system is really working, it is not possible to circumvent it and so if there is no money, you are not going to be entering into that contract in the first place and so this is actually helping us as you see, very much on target as far as our deficit is concerned for example through the first half of the year and I think that this is also seen in the domestic money market where you have seen interest rates coming down from 22 per cent last year, and just a year later, you have 11.9 per cent.

And if you are borrowing rampantly in the domestic market, you will see that interest rate declines. So the simple answer is that the debt stock in terms of its impact is burdened on the economy is not actually increasing. The debt-to-GDP ratio is actually stabilising and we are hoping to bring it down by the end of the year even if marginally. Thank you very much.

Business News of Tuesday, 18 July 2017

Source: classfmonline.com