• A Former Finance Minister has stated that borrowing monies from international agents to pay debts isn’t the right approach

• Seth Terkper said the money being used in establish development bank should have rather been invested in NIB

• He said the country could have taken advantage of the discovering oil to overcome the disturbance of economic instability

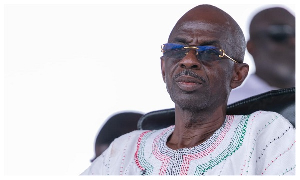

Former Minister of Finance, Seth Terkper, has explained the factors that are causing Ghana’s economy to shrink despite efforts being made by the government to revamp it.

According to him, borrowing monies from international agents to pay debts isn’t the right approach to use but rather, local proceeds and internal revenues could be amassed to help fix the economy.

Speaking in an interview on GhanaWeb’s business programme, BizTech, he noted that, natural disasters and other external factors trigger a country to borrow but stabilization of the economy is key.

“We got advice from countries who have been through a crisis on what to do to save the country from any future crisis, so we formulated petroleum revenue act and all indications are that the outcome showed that we were making good progress with one oil field, so we put some money aside for future generations from oil. As a nation, you should save for future purpose so we put some money aside for the budget and we said given the fact that we were spending too much on consumption and not much investment, we said the money going into the budget should be such that, 30% will go for current expenditure and then 70% for capital investment or development,” he said.

Mr Terkper said the country’s economy cannot be stabilized during a crisis because much money is needed to save the situation.

“We had a devastating situation like that in previous regimes and we decide to put some money aside to save the situation, so we set up the stabilization fund to stabilize the economy and you don’t stabilize the economy during a crisis or you don’t bring it back during the period of crisis. You prepare before the crisis and during the crisis, you utilize the resources, so we built the stabilization fund. First, we took GH ¢250 million when we had crude oil price falling and this time round under COVID-19 we took $250 million to support COVID-19 so that should tell you that the objectives were achieved,” he noted.

Meanwhile, Mr Terkper has indicated that the decision to set up a new development bank is a misplaced priority as a nation.

According to him, the money should rather be given to the National Investment Bank (NIB) to make it productive.

Mr Terkper noted that it is a misplaced priority and a duplication of development banks in the country and will have no direct developmental impact on the nation.

“They should have given the money to NIB, it was established as our investment bank by Nkrumah, there is no need for any new development bank. It is duplication, they only making NIB a commercial brand, the NIB was never meant to be a commercial brand, it is just like Agriculture Development Bank, and that is a commercial bank for Agric, but NIB was an investment bank so what is the difference between an investment bank and a development bank?” he queried.

Watch the Full interview below with Amos Ekow Coffie:

Business News of Saturday, 29 May 2021

Source: www.ghanaweb.com

BizTech: Seth Terkper speaks on factors leading to poor economic performance

Entertainment