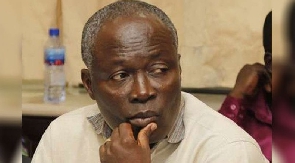

The Bank of Ghana (BoG) Governor, Dr. Ernest Addison, has emphasised that the primary objective of the bank’s stance on the new Bank of Ghana Act of 2002 (Act 612) is to guarantee clarity of the law.

Dr. Addison pointed out that the current Act requires an amendment to address inconsistencies and challenges with its implementation; and to clarify measurement issues, procedural matters and other related aspects to facilitate a smoother process.

“We need to improve it to make these things a little easier,” he asserted at a press briefing following the 112th meeting of the Monetary Policy Committee (MPC).

His comments come on the back of indications from the International Monetary Fund’s (IMF) staff report that the Bank of Ghana Act will undergo revisions to strengthen the central bank’s independence and mitigate government dominance in fiscal matters.

According to the IMF, the amended Central Bank Act will introduce a stricter limit on monetary financing, mechanisms to monitor and enforce compliance, as well as a clear definition of emergency situations that would warrant a temporary lifting of the limit. However, during a press briefing by the Monetary Policy Committee (MPC) of the Bank of Ghana, Dr. Ernest Addison raised concerns about measurement issues – particularly regarding the five percent central bank financing to government.

The proposed changes will be based on recommendations of the safeguards assessment update. As an immediate action, the Ministry of Finance and Bank of Ghana have signed a memorandum of understanding, ensuring zero monetary financing throughout the IMF programme.

He however questioned whether it should be assessed against a stock of claims on government at a specific point in time, or as a flow from another period. Additionally, he called for a precise definition of emergencies, stating: “Let’s define it very carefully and make it clear under which conditions the rules can be breached. Furthermore, the procedural issues within the laws require clarification; such as determining whether the reporting to parliament should be carried out by the Governor or Minister of Finance”.

Dr. Addison further noted that most of the reporting is currently done through the Minister of Finance, clarifying that the Governor does not have a direct obligation to parliament. He emphasised the need to address these issues appropriately, stating: “All of these issues have to be properly clarified, and I believe there is a need to do that”.

Responding to inquiries about why the Bank of Ghana does not introduce a new Act instead of revising the existing one, the Governor highlighted that the two approaches are not necessarily mutually exclusive. He acknowledged previous attempts to improve the current Act in 2016, but pointed out that inconsistencies and implementation challenges still persist.

Furthermore, he highlighted the unique circumstances of the economic crisis in 2022, stating that even with a perfect law, the choices faced were either grinding the economy to a halt or allowing government operations to come to a standstill – which would have been worse.

“So the issue of the law is fine; but when you’re in an economic crisis, things have to be done differently,” he concluded.

The IMF also mentioned that the revised Act will review government’s gold purchase and gold-for-oil programmes, along with associated risks for the Bank of Ghana.

The Fund believes that the debt restructuring will impact the Bank of Ghana’s balance sheet, requiring government and the Bank to assess the consequences and develop plans for recapitalisation with technical assistance support from the IMF.

Additionally, a comprehensive analysis of the risks associated with government’s gold-for-oil programme will be conducted by the Bank of Ghana, with its findings to be reported to the board. The BoG’s gradual exit from the programme will be undertaken as the economy stabilises.

This is in line with efforts to enhance central bank independence and monetary policy credibility. The amendment aims to reduce the overdraft limit, improve compliance, refine the conditions under which the limit can be temporarily breached, and determine the permissible breach extent for each emergency category.

Watch the latest edition of BizTech and Biz Headlines below:

Click to view details

Business News of Monday, 29 May 2023

Source: thebftonline.com