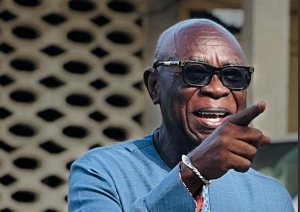

Former NDC MP, George Loh, has criticized officials of the Bank of Ghana (BoG) over what he describes as poor management of issues regarding the revocation of UT and Capital Banks’ licenses.

BoG on Monday August 15, announced publicly the withdrawal of licenses of UT and Capital Banks as well as a takeover of both institutions by the Ghana Commercial Bank (GCB).

Following the announcement, some workers of UT Bank were reportedly, prevented from entering the banking halls on Monday morning and could also not access their accounts till about 1pm.

Speaking on the issue on JoyNews’ Newsfile program, Saturday, George Loh said the BoG’s decision was irresponsible. Mr. Loh said the Bank of Ghana should have implored a bi-partisan approach to resolving the issue rather than resorting to making hasty decisions which is a clear breach of the country’s laws, particularly, the security and exchange law.

“It is clear that the Bank of Ghana breached certain laws, the security and exchange law 2016, 929 states as part of the functions that they must approve every takeover, did they approve it? Is there any evidence?”

“If you have a bank on the stock market which for five years haven’t submitted statements of account, were they aware, what did they do within these five years?”

“There are a lot of questions to be answered so I don’t think there’s anything wrong if we try to find a bi-partisan approach to solving the issues. If everything was smooth, the Bank of Ghana wouldn’t be talking about going after directors to see if they did the right thing. “

“If the Bank of Ghana can wake up one morning and take such a decision without recourse to the laws, it is worrying and they are giving us the impression as though they acted swiftly. No! The signals were there for how many years?” he queried.

The former legislator argued that management of BoG, having prior knowledge of the state of affairs of both banks and an imminent collapse, should have consulted management of both banks prior to the announcement, and informed them of their decisions so that they could also inform their customers accordingly.

This, he said, would have gone a long way to prevent the near-chaotic situation customers and workers had to face following the news Monday morning.

“We are only looking at things from the legal perspective alone but from the social point… how would you feel if you wake up in the morning, iron your clothes, get to the office and the policeman tells you that you cannot enter. How would you feel? Or you are going to the bank, your wife is in the hospital, they say buy a drug, you don’t have money, you go to the bank to pick deposits to buy drugs and you are told you can’t have access to your deposits.”

“The Bank of Ghana could have handled this thing in a more professional, in a smoother manner and that is what we should be talking about because this would not be the first time that banks will be taking over. I’m saying, let’s use best practices. What stopped the Bank of Ghana from consulting the board when they decided that this is where they wanted to go?”

“There were senior managers of the bank that you could call and say that from Monday this is what is happening, what is going to happen is that, let depositors know that we are doing a special exercise and that until 1 O’clock, the bank cannot work so that everybody is ready…”

For him, the fact that deposits are safe is no justification for the bank to do what they did.

“Like everybody is saying, you will say they are gratified that deposits are safe, but that is not what it is. The laws are made to be obeyed so that we don’t get to where we are”.

Business News of Monday, 21 August 2017

Source: www.ghanaweb.com

BoG breached laws by revoking UT, Capital Bank licenses - Loh

Entertainment