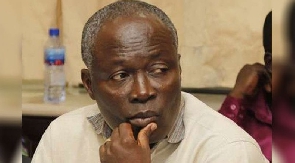

Governor of the Bank of Ghana (BoG), Dr. Abdul Nashiru Issahaku, has called on central banks in the West African sub-region to strengthen the security features of their currencies in line with changing technology.

“New designs must win public acceptance, incorporate requisite security features and meet durability and machine processing standards. Fitness standards for currency in circulation must be set and monitored whether currency sorting is carried out in-house or outsourced.

For example, some central banks have moved from paper substrate to polymer notes in line with technological developments, changes in world-wide trends on secured currency, and the cost-effectiveness of production and handling.

Indeed, polymer banknotes tend to be more cost-efficient, more durable and last longer, especially in our type of humid climatic conditions,” Dr. Issahaku said in a speech delivered on his behalf by Ms. Grace Akrofi, Director, Statistical Department of the BoG at the on-going West Africa Institute for Financial and Economic Management (WAIFEM) training programme in Accra.

Dr. Issahaku said that effective currency management commences with a strategic analysis of the currency life-cycle, which would be impossible without accurate forecasts of the demand for banknotes.

“Accurate forecasting encourages more efficient procurement and reduces stockholding costs. A disciplined and balanced approach to currency management reduces opportunity losses and thus enhances the smooth functioning of the banking system,” he said.

The workshop was organised by WAIFEM and is designed to deepen the knowledge and upgrade the analytical skills of central banks in the sub-region in the performance of their currency management functions.

According Prof. Akpan H. Ekpo, Director General, WAIFEM, the training programme was occasioned by feedback received from the previous workshops which showed that capacity building is needed in currency management, considering that cash is still central to most financial transactions in most countries in the sub-region.

“Even though efforts are being made towards the achievement of a cashless economy in some of our jurisdictions, the important role of currency management as an integral part of overall economic management calls for a sustained effort by all stakeholders,” Prof. Akpan said.

Top executives from the central banks and revenue authorities from The Gambia, Liberia, Nigeria, Sierra Leone and Ghana will participate in the two-week training programme.

Click to view details

Business News of Thursday, 23 March 2017

Source: b&ft.com