The Bank of Ghana says it will explore the possibility of setting a minimum loan to deposits ratio to ensure that more deposits mobilised by banks are channelled to viable private sector projects.

According to the Governor of the bank, the move is expected to support and strengthen the growth of credit to the private sector.

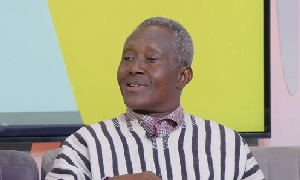

Dr. Ernest Addison speaking at the Monetary Policy Meeting in Accra on Monday, November 25, said further consultations, with the banking industry, will be held to determine the impact of such a regulatory measure, and if warranted, it will determine the level of such a ratio and appropriate monitoring and enforcement mechanisms to promote its effectiveness.

“The Bank of Ghana is putting in measures to reinforce the existing credit infrastructure by, among other things, strengthening enforcement of the credit bureau system under proposed Regulations to be made by Parliament pursuant to the Credit Reporting Act of 2007 (Act 726), and further strengthening the collateral enforcement mechanism under a new Borrowers and Lenders Bill to improve the quality of loans made by banks as well as facilitate recovery of loans and collateral,” the Governor said.

Dr Addison added that the Bank of Ghana is to set aside 2 percent of the central banks’ primary reserve to support targeted lending to Small and Medium Enterprises (SMEs) as part of the Enterprise Credit Scheme announced by the Finance Minister in the 2020 Budget and Economic Policy.

The Governor assured that the funds will be kept at the Central Bank and made available to institutions that participate in the Scheme.

Business News of Tuesday, 26 November 2019

Source: www.ghanaweb.com