The Governor of the Bank of Ghana (BoG) has commended commercial banks for their compliance with the central banks new corporate governance directives issued in the result of the banking sector clean-up.

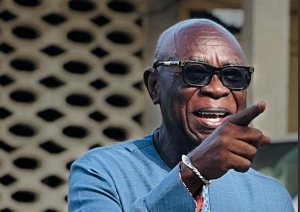

According to Dr. Ernest Addison, the directive by the central bank was intended to create a more resilient and strong banking sector to enhance the economy.

“The bank’s enforcement of the Corporate Governance Directive has led to several board chairs and CEOs of banks ending their tenure, while Board members who had served for prolonged periods have been replaced,” Dr. Ernest Addison said this at the launch of the Absa Bank Ghana Limited on Monday, February 10.

“Results of a recent survey indicate full compliance with requirements of the Corporate Governance Directive on the size, structure, composition and qualification of bank Boards; due diligence in the appointment of key management personnel; and separation of the positions of CEOs and Board Chairs,” he explained.

The Governor added that that a total of 184 bank directors undertook the mandatory annual Directors’ corporate governance Certification training programme.

“Of the number, over 50 percent have fully completed the programme, while the rest who are at various certification stages will be certified by the deadline of end-March 2020,” the governor noted.

The move by the BoG follows an earlier shutdown of nine commercial banks between 2017 and 2019 after it cited poor corporate governance structures as contributing to the poor running of the affected institutions.

Dr. Addison indicated that as regulators, the BoG will continue to ensure that banks and financial institutions are held accountable by applying the laws pertinent to the sector.

The Governor used the occasion to commend the newly launched Absa Bank Ghana to seek to become a forward-thinking and digitally-led bank that will provide a more accessible and convenient banking avenue.

“The central bank expects the changeover to Absa to carry along the level of excellence, leadership, and professionalism that has become synonymous with the 100-year Barclays heritage in Ghana. This is what has endeared the general public to Barclays, and that is what will be expected from Absa.”

“I believe that Absa Bank Ghana will carry the same principles into the next 100 years, and the new footprints will become even more exciting if the Ghanaian public have an opportunity to become shareholders in Absa Bank Ghana in the near future,” Dr Addison said.

Business News of Monday, 10 February 2020

Source: www.ghanaweb.com

BoG lauds commercial banks' compliance with corporate governance directives

Entertainment