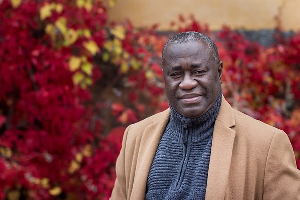

Geoffrey Kabutey Ocansey, Executive Director, Revenue Mobilisation Africa, has opined that the Bank of Ghana would need recapitalization just like the banks it collapsed due to how affairs have been managed.

The economist argued that the central bank has in recent times failed to manage its affairs properly, leading to losses over the past two years.

The BoG reported a loss of GH¢10.5 billion for the financial year ending in 2023.

It justified the loss by stating that the primary reason for this loss was a significant increase in total interest expenses on open market operations by the Central Bank, which increased by GH¢6.7 billion during the review period.

The Bank explained that the rise in expenses was necessary to manage the economy’s excess liquidity.

It was also meant to support the disinflation process as part of the broader macroeconomic adjustment programme.

The Bank of Ghana and its subsidiaries had total liabilities surpassing total assets by GH¢65.36 billion as of December 31, 2023.

The total operating expenses for 2023 were GH¢19.2 billion, a significant decrease from the GH¢66.9 billion recorded in 2022.

In August of the previous year, the BoG also defended its new $250 million headquarters.

In response, Mr. Geoffrey Kabutey Ocansey stated that the circumstances that caused the central bank to supervise the collapse of several financial organisations are the same as those that are currently affecting them.

Speaking in an interview on Frontline on Rainbow Radio 87.5FM, he said one of the major reasons why the BoG collapsed the banks was poor governance and a breach of the guidelines in the sector.

He warned that failing to address these losses might have a detrimental impact on the economy, including influencing monetary policy, jeopardising the central bank’s independence and reputation.

“If care is not taken, the Bank of Ghana would have to be recapitalized based on the same reasons it used in collapsing the banks. The Bank of Ghana advised the government to collapse banks and other financial institutions. But when you evaluate the work of the BoG currently, you will discover that they are worse than the banks that collapsed. The bank would have to be recapitalized based on the same principles it used in the collapse of the other banks,” he told host Kwabena Agyapong.

He stated that because the bank was unable to finance the government’s budget or grant loans to the government, the government has now relied on other banks, causing Treasury rates to rise and increased interest in loans to SMEs.

Business News of Monday, 24 June 2024

Source: rainbowradioonline.com