The Monetary Policy Committee (MPC) of the Bank of Ghana on Wednesday increased its policy rate by a 100 basis points to 19% amidst continued softening in business and consumer confidence alongside heightened inflation expectations.

The increase in the MPC’s Policy Rate- which signals interest rate trends- is the second time this year that the Central Bank has moved to tighten its monetary policy in a bid to control inflationary pressures expected from the recent increase in utility tariffs and transportation costs as well as the depreciation of the Cedi.

Inflation rate moved from 14.7% in April -when the MPC pegged its policy rate at 18%- to 14.8% at the end of May this year.

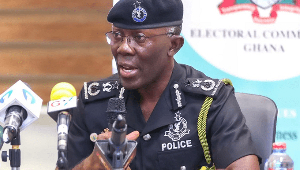

Dr. Kofi Wampah, the Governor of the Bank of Ghana who is also the Chairman of the MPC, told the media at the end of the Committee’s 60th meeting that, headline inflation, which has slowed on a month-on-month basis, continued to drift further away from the target band of 9.5 and 9.7% underpinned by cost-push factors alongside heightened inflation expectations by businesses and the financial sector.

He said despite the possible increment in petroleum prices and its attendant effects on other sectors of the economy, government’s inflation target could be achieved.

Dr. Wampah explained: “The persisting fiscal and exchange rate pressures have provided additional impetus to the worsening inflation outlook. Other risks related to the inflation outlook include the recent rapid growth in monetary aggregates such as credit to the private sector and money supply.

“Our latest inflation forecasts which factor in possible petroleum price increases and liquidity conditions show that barring any significant shocks, inflation is likely to return to the target range of 9.5±2 percent by the last quarter of 2015.

“On the balance therefore, the Committee viewed risks to inflation as elevated and decided to increase the policy rate by 100 basis points to 19 percent to contain inflation pressures and realign interest rates in favour of domestic assets.”

Business News of Thursday, 10 July 2014

Source: B&FT