The Bank of Ghana has once again underscored its unwavering commitment to achieving price and financial stability, dismissing suggestions that it would deliberately keep interest rates elevated to generate profits.

The central bank’s stance comes amid elevated inflationary pressures and a delicate balancing act between curbing rising prices and supporting sustainable economic growth.

In its previous Monetary Policy Committee (MPC) meeting, the Bank of Ghana maintained the monetary policy rate at 29 percent, citing persisting upside risks to inflation. This decision underscores its resolute focus on bringing inflation down to its medium-term target, which it deems a precondition for ensuring economic growth and improving the welfare of the Ghanaian population.

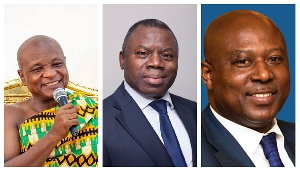

“Bringing inflation down to the target level is a precondition for achieving sustainable economic growth and, over the long-term, ensuring economic prosperity in Ghana and increasing the welfare of the population,” Director of Communications at BoG Bernard Otabil, said in an interview.

The decision to hold rates steady amid inflationary pressures has sparked speculation in some quarters that the Bank of Ghana might be inclined to keep borrowing costs elevated to generate profits. However, the Director of Communications categorically dismissed such claims, emphasising that central banks are not commercial entities driven by profit motives.

“Anyone who would make such a claim perhaps does not fully understand central banking because high interest rates are inimical to the operations of central banks,” Mr. Otabil said. “High interest rates raise the cost of open market operations and lead to substantial losses.”

He stressed that central banks are mandated to provide the public good of low and stable inflation, even if it means incurring losses in pursuit of that objective.

“Central banks, by the nature of their work, are supposed to provide a public good and that public good is low and stable inflation, which comes at a cost,” Otabil stated, adding: “Indeed, a central bank can incur losses, have negative accounting equity and still function effectively—a loss does not imply a loss of policy effectiveness.”

Otabil underscored that the Bank of Ghana’s mandate is to achieve price stability and it cannot trade off this objective for profits.

“However, it is essential to recognise that central banks are mandated to provide the public good of low and stable inflation and cannot trade off the policy objective of stable inflation for profits,” he said.

The central bank’s commitment to fighting inflation comes as its inflation expectations survey across banking, consumer and business sectors has indicated overall stability in future inflation expectations. However, global factors and domestic pressures continue to pose challenges.

While global inflation has continued to alleviate, primarily due to declining food and energy prices coupled with tight monetary policies worldwide, persistent tight labour markets and the enduring effects of currency depreciation have sustained underlying inflation pressures in Ghana.

Mr. Otabil acknowledged the complex nature of monetary policy operations and the need for humility in navigating economic uncertainties.

“The unique nature of central banks is that sometimes losses are the price they pay for meeting objectives—ensuring stable prices, keeping the financial system safe and stable, and supporting growth We perform monetary policy operations with humility because the economy is not deterministic,” he concluded.

Business News of Monday, 20 May 2024

Source: thebftonline.com