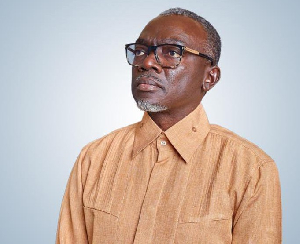

The Bank of Ghana will not treat with soft gloves enforcement of the yet to be announced minimum capital requirement for commercial banks in the country, its Governor, Dr. Ernest Addison, has said.

Speaking in Accra at the Ghana Economic Forum, Dr. Addidon said the previous situation where the central bank was lenient on banks regarding capitalisation requirements will no longer be the case going forward.

“In the past, when new capital requirements are announced, and they are given a two-year period to meet the requirement, they never really met it. In fact, the GH¢120 million that was announced was supposed to be for new entrants and the bank has not really clarified what that level of capitalisation means for banks that were already existing. We are not going to have that happen again, going forward.

Once we announce the new capital requirement, this will be accompanied by measures of enforcement. We will do this in a very orderly manner. We are not going to see any disorderly consolidation in Ghana if this is a way we have to go”, he said.

The central bank’s decision to increase the minimum capital requirement has been met with some misgivings by industry players and financial analysts, who argue that a higher level of capitilisation is not the only solution to boost capacities of banks.

Managing Director of GT Bank, Lekan Sanusi, said at the forum that: “If you want to have a strong banking system, I think the discussion should go beyond capital, because capital alone does not make a bank strong.

In Ghana, for instance, if today, deposits to GDP is at 26 percent, the fundamental point, therefore, to say is that, the level of financial deepening is not deep enough. And what we should rather be looking at is to ensure more financial deepening, and the answer to that will not be essentially capital.”

A banking corporate governance expert and CEO of Universal Capital Management, Dr. Richmond Atuahene, told the B&FT last week that, the central bank must adopt a fragmented banking system which will set different capital requirements for banks based on the category they fall under.

“Bank of Ghana may have to abolish the concept of the universal bank, where one minimum capital requirement is prescribed for all the banks in Ghana and replace it with the fragmented banking system, where banks are relicensed into commercial, merchant, development, and other specialised banks, with different minimum capital requirements, based on their risk appetite and business orientation,” Dr. Atuahene said.

Plans to improve banking supervision underway

Dr. Addison further stated that his outfit is currently considering a comprehensive plan to improve banking supervision in the country, especially, in the area of microfinance, which has seen some lost confidence following the infamous DKM saga.

“The Bank of Ghana will continue to strengthen the resilience and the stability of the banking system... The new administration is committed to its medium term programmes to stabilise the economy and improve the business environment for sustainable growth,” he said.

Business News of Wednesday, 9 August 2017

Source: thebftonline.com