The Food and Beverages Association of Ghana (FABAG) has strongly opposed the recent call by the Association of Ghana Industries (AGI) for new digital tax stamp machines, labeling the move as "misplaced" and potentially financially burdensome for businesses already struggling with economic challenges.

This comes after the AGI suggested adopting new digital tax stamp machines to improve tax compliance among industries.

However, FABAG argues that these new machines would rather impose undue financial burden on companies, many of which are still recovering from the impacts of the pandemic and facing increasing operational costs.

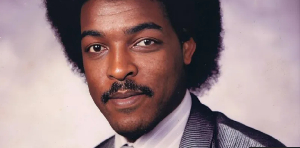

In an interview with GhanaWeb Business, the President of FABAG, John Awuni pointed out that businesses cannot afford the additional expenses associated with new digital tax stamp machines.

"We urge stakeholders to explore alternative solutions that can enhance revenue collection without increasing the operational costs for local businesses," Awuni said.

FABAG's stance highlights the broader concerns among industry players regarding the sustainability of current tax policies and their impact on economic recovery and growth.

While the AGI's proposal for updated digital tax stamp machines aims to streamline revenue collection and address tax compliance issues, FABAG is calling on policymakers to engage in further consultations with industry stakeholders to ensure that any changes are economically viable and support business resilience.

MA

Watch the latest edition of BizHeadlines below:

Click here to follow the GhanaWeb Business WhatsApp channel

Business News of Thursday, 31 October 2024

Source: www.ghanaweb.com

Businesses can't bear costs of new tax stamp machines - FABAG replies AGI

Entertainment