By Tommy Ekpe

Focus on the raging debate over the $3billion China Development Bank (CBD) loan facility the country has secured should be directed to the uses of the loan and the commitments given by government, the Executive Director of the Centre for Policy Analysis (CEPA), Dr. Joe Abbey has averred.

According to him, rather than focusing on the need for such a loan, the current debate should focus on the uses of the loan and commitments given by government, particularly in paragraph 1210 of the 2012 Budget Statement.

He said deriving value-for-money from these resources required that they be self-financing and growth-enhancing, particularly with jobs.

Addressing the 63rd Annual New Year School and Conference on Tuesday, Dr. Abbey observed the most binding constraint to growth that Ghana faces was the savings-investment gap, resulting in an annual financing gap of between US$2.5 billion and US$3.5 billion that needed to be raised from private investors and public sources both domestic and international.

The CEPA boss was making a presentation on “Challenges and Prospects of Infrastructural Development in an oil and gas economy”.

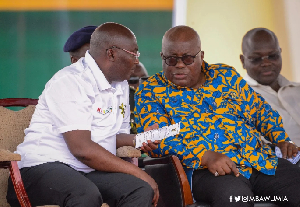

Quoting from a 2007 Consultative Group Meeting report on Ghana, authored by a former deputy governor of the Bank of Ghana, Dr Mahamudu Bawumia, he said ‘the Government of Ghana was even more convinced about the case for accessing the international capital markets to begin the process of filling some of this gap which could also accelerate investment from the private sector’.

He explained that the arguments advanced by Bawumia on the fact that the most binding constraint that Ghana faces is the savings-investment gap led to moves to source external financing with investments in power, transport, water supply, and ICT as top priorities.

“These were joined by investments in health and education to provide the levels of human capital that will be critical for Ghana to move toward middle income status”, he stated.

According to Dr Abbey, infrastructure bottlenecks were recognized as critical constraints to growth, and with domestic savings having proven inadequate in spite of efforts made to improve domestic resource mobilization, there still exists a residual savings-investment gap which calls for external financing.

He said Bawumia’s report, observed that donors and the IMF in particular were hesitant about this policy stance of accessing the international capital market.

“First they were worried that Ghana would begin a new cycle of unsustainable debt accumulation and secondly, Ghana may set an example for HIPC countries that after obtaining debt relief may pursue this path.

The report noted that this was, however, at the same time that Ghana was being described by the Fund as a “mature stabilizer”, adding that their arguments against Ghana’s strategy did not appear consistent with their own assessment of the performance of the Ghanaian economy.

On the management of the oil and gas sector, Dr. Abbey said studies have shown that if oil revenues are invested prudently — whether in improved infrastructure such as roads, railway and ports, or in better education, health and sanitation — this could be expected to boost incomes and living standards, making oil a blessing.

“The international experience strongly suggests that fiscal discipline must be maintained; and in poor countries with weak institutions strengthening of these, especially for good economic management and governance, is a critical requirement to make the oil resource a blessing”, he stated.

He said historical experience shows that good governments that spend their money on essential public services realize very high rates of return, adding that one study estimated that each additional one percentage point of GDP in transport and communications investment increased growth by 0.6 percentage points.

According to Dr. Abbey, the rate of return to infrastructure projects averages between 16 to 18 per cent per year, stating that the returns to maintenance spending on existing infrastructure — such as road maintenance — are even higher, perhaps as much as 70 percent.

On Public Private Partnerships (PPP), he said the private sector shows up as a much smaller contributor for Africa with nearly two-thirds of private sector finance going into telecommunications.

“And as African countries were gearing up to attract private participation, many sponsors were pulling out of developing countries, driven by pressure from shareholders to exit uncertain markets and reduce risk”, he added.

The CEPA Executive Director noted that inclusive of a risk premium, the cost of capital in this sector is quite high and may shoot past the point where most new infrastructure projects can generate adequate private return, adding that the risk premium is exacerbated by the significant currency mismatch that exists in many infrastructure transactions, where revenue streams denominated in local currency do not match foreign currency debt obligations.

He is therefore encouraging innovative financing arrangements and instruments, saying that one such arrangement would involve Overseas Development Assistance (ODA) being used to leverage private sector finance by underwriting risk in public private partnerships in infrastructure investment and service provision. E-mail: thebusinessanalystgh@gmail.com

Business News of Thursday, 12 January 2012

Source: --