The Civil and Local Government Staff Association, Ghana (CLOGSAG) says it will not compromise on the January 1, 2020 implementation of the TIER 2 Pension Scheme.

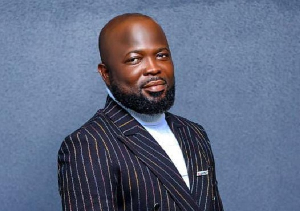

Executive Secretary of CLOGSAG, Isaac Bampoe-Addo, said, the continuous extension of implementation of the Scheme, empowers the Social Security and National Insurance Trust (SSNIT) to monopolise pension administration in the country, thereby rendering workers worse off.

Addressing a press conference in Accra yesterday, he stated that, none of the public sector occupational pension schemes had indicated that it needs more time or further extension of the implementation date.

Mr Bampoe-Addo said the association would not entertain further delays on the implementation of the scheme as government had since 2016 commenced payment of the five per cent deduction towards Tier 2 pensions to custodians of the public sector occupational pension schemes.

He was reacting to claims by the Trade Union Congress on Monday that contributions of most public sector workers were transferred from the Bank of Ghana to Corporate Trustees just last year.

The workers argued that the transfer which was done recently, made it impossible for those funds to generate returns that could meet the expectations of workers and the pension reforms exercise.

However, Mr Bampoe-Addo said the claim was false as government had further transferred the five per cent deductions towards pensions for private sector workers to their schemes years before the transfer of the Temporary Pension Fund Account (TPFA) to public sector schemes in December 2017.

He explained that the TPFA at Bank of Ghana was transferred to the custodians with accumulated arrears, interest compounded quarterly and with penalties effective January 1, 2010.

The position of TUC that public sector schemes would require more time to invest workers contributions before they could reach the level of lump sums or equal to or more than what SSNIT would have paid, he said was misleading and an attempt to cripple and destroy the Tier 2 pension scheme.

The Tier 2 pension scheme, which was the final lap of the 10-year pension reform exercise started in 2010, Mr Bampoe-Addo said, had been analysed and demonstrated as offering better earnings to workers than what was currently provided by SSNIT.

For members who were part of the SSNIT Scheme before January 1, 2010, he noted that SSNIT was liable to pay part of the Tier 2 benefit in the form of past credit.

“SSNIT ought to be made to pay the appropriate rates of interest on worker’s contributions in order that the envisaged benefits under the occupational pension schemes would be realised,” Mr Bampoe-Addo said.

The disagreement between the labour unions follows an announcement by SSNIT that it would from 2020 commence payment of monthly pensions to retirees, while the various occupational pension schemes took over the payment of lump sums.

These changes, according to the reforms, were expected to improve pension payouts and make pensions an integral part of economic development.

Click to view details

Business News of Friday, 20 December 2019

Source: ghanaiantimes.com.gh

CLOGSAG against extension of Tier 2 pension implementation date

Entertainment