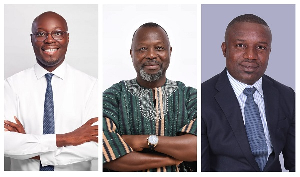

The Deputy Ranking Member on Parliament's Food and Agriculture Committee, Dr. Seidu Jasaw, has revealed that COCOBOD encountered serious challenges in repaying last year's syndicated loan.

He expressed concerns about the organization's financial stability, highlighting the potential risks for Ghana's cocoa industry as a whole.

Dr. Jasaw pointed to mismanagement and inefficient resource utilization under the current administration as the primary causes of COCOBOD's repayment struggles.

He emphasised that these financial difficulties are a symptom of deeper systemic issues within the organization, which require urgent attention to prevent further decline.

Recently, COCOBOD's CEO, Joseph Boahen Aidoo, announced that the organization will not seek offshore syndicated loans for the first time in three decades to finance the purchase of cocoa beans for the 2024/2025 crop season.

Aiming to procure approximately 650,000 metric tonnes of cocoa, Aidoo claimed that COCOBOD would rely on its internal operations for funding.

He outlined an elaborate plan to reduce the organization's reliance on high-interest loans from international lenders.

However, in response to this announcement, Dr. Jasaw, who is also the Member of Parliament for Wa East, questioned the accuracy of Aidoo's statements.

He argued that the real reason COCOBOD is not pursuing offshore loans is that the international market has lost confidence in the organisation due to its difficulties in repaying last year's syndicated loan.

Dr. Jasaw reiterated that these financial strains reflect deeper management issues within COCOBOD that must be urgently addressed to safeguard the future of Ghana's cocoa sector.

"This is a dire situation. I was expecting COCOBOD to be forthcoming with the information so that Ghanaians can interrogate it but when you try to flip it over and bring a deliberate policy shift when really it is your incapacity and therefore inability to be able to solve crisis, I think that is disingenuous and Ghanaians shouldn't be taken for granted."

"The syndicated banks refused them the loan because COCOBOD's financial position is not good at all, and they also have concerns about production. They struggled to pay back the last year's syndicated loan. The Ministry of Finance had to support them with about $70 million or so in July before they were able to pay back the loan."

Business News of Thursday, 22 August 2024

Source: classfmonline.com