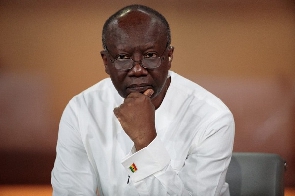

A coalition comprising three leading civil society organizations that focus primarily on state economic management have formally responded to key elements of the new fiscal initiatives proposed by Finance Minister Ken Ofori-Atta to Parliament a week ago.

The coalition of CSOs comprises the Natural Resource Governance Institute, Friends of the Nation and the Centre for Public Interest Law, all of them highly reputed policy think tanks.

In all, the coalition gives government a pass mark, which will be useful in drumming up wider stakeholder support for the new fiscal game plan. Says the official statement from the coalition: “We find the (Finance) Minister’s statement not only responsible but timely and we commend government on the positive steps contained in the statement.”

However with regards to the proposed lowering of the cap on the GSF the coalition points out that the new cap is” very low and has the potential to trigger government’s appetite for borrowing against the sinking fund to the disadvantage of the constitutionally mandated Contingency Fund established to mitigate the impact of fiscal imbalances.”

It points out that it is the failure to create adequate fiscal balances that has forced government’s hand to propose these emergency measures in the first place. It further warns that “In the absence of a clear plan on how the proposal would roll out and when the proposed (lower) cap would be restored to its original threshold there is no guarantee that the excess amounts beyond the proposed lower capping threshold of US$100 million would not be creamed off into the sinking fund for debt servicing purposes rather than into the contingency fund to finance the proposed CAP.”

Nevertheless the coalition concludes that: “In the circumstances we must hasten cautiously in approving the Finance Minister’s plan to lower the current cap on the GSF.”

However, the coalition opposes the use of the Ghana Heritage Fund, which currently has some US$591.1 million in it.

Interestingly the coalition further points out that the revenues lost to tax exemptions would have been enough to alleviate the impact of COVID 19 without amending the use of allocations to Ghana’s petroleum funds. It notes that tax exemption have grown fromGHc391.9 million in 2010 (equivalent to 0.9 percent of GDP) to GHc5,269.99 million in 2017, equivalent to 2.6 percent of GDP, which is more than the projected financing gap of 2.5 percent of GDP for 2020. The coalition therefore calls on government take a serious look at the tax concessions regime so as to create the fiscal space to deal with emergencies such as the coronavirus outbreak in future.

The coalition also calls for a stipulated threshold on the margin by which the fiscal deficit can exceed the five percent cap, recommending that it should not be by more than one percent. It also wants the utilization of CAP funds to prioritize the poor and vunerable, primary healthcare providers, informal sector businesses, women and persons with disabilities.

Finally it wants a specific time frame set on the new proposed initiatives.

Business News of Monday, 6 April 2020

Source: goldstreetbusiness.com