Indigenous bank, Capital Bank has launched a campaign dubbed, “V12” aimed at giving customers superior value.

It is to also to consolidate the bank’s position as the best retail bank and the best bank in terms of savings and deposits.

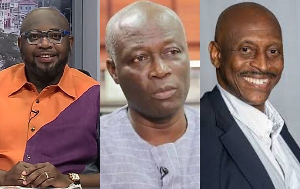

The Managing Director of the bank, Rev. Fitzgerald Odonkor, said the mechanics of the promotion was to pay 12 per cent interest rate at the end of every month on all local currency savings and current accounts that grow their account balances by GH?50 or more.

“The “V” stands for Value and the “12” represents 12 per cent interest rate. “V12 is also synonymous with an extremely high performance engine,” he said.

Therefore, he said, the bank aimed to use the V12 promo to propel customers towards the actualization of their financial goals in line with the bank’s value proposition of delivering superior value.

The Head of Sales at Capital Bank, Mr Stephen Ped Andam, said operating currents accounts did not seem rewarding because they are normally associated with charges.

He said Capital Bank was changing the narrative with the V12 campaign by paying 12 per cent interest on savings and current accounts, be it a personal, priority or business account.

“We have also made cash deposits easy and convenient since Capital Bank customers do not have to visit the banking hall to make cash deposits. All they have to do is to purchase SpeedPay vouchers worth the amount of cash they want to deposit from any Allied Oil filling stations and other SpeedPay agents nationwide and pay the cash into their bank accounts through their mobile phones,” he added.

Capital Bank is noted for innovation and it was the first bank to introduce a service that enabled customers to make cash deposits into their bank accounts through their mobile phones in 2011.

Last year, it also launched the innovative V-man campaign where individuals were given free cash to open bank accounts. The bank currently has 23 branches nationwide and it is expected to increase its branch network to 26 by the end of the year.

Click to view details

Business News of Friday, 12 May 2017

Source: Nana Yaw Kesse