File photo of Ghana cedis notes

File photo of Ghana cedis notes

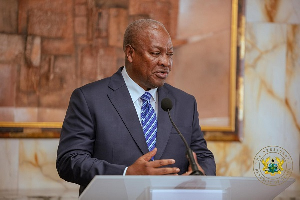

IMF meetings signal Africa financial support The IMF at its annual meetings in Washington this week indicated increased support for economic recovery in Africa. The IMF wants to speed up long-delayed debt restructurings for Zambia and Chad to institute by year-end. In Zambia, a combination of tighter monetary and fiscal policies and the elimination of custom duties have tamed inflation to 9.9% from 21% in the past year. The Kwacha has been Africa’s best performing currency, rallying around 18% year to date, after Zambia secured a $1.3bn bailout package from the IMF. Prospects remain positive given the debt restructuring plans to be concluded this year in addition to improved global consumption for the copper producing country. Debt restructuring should also help spur recovery for Chad amid a pick-up in oil and agricultural output. In other news from the IMF meetings, the Fund is seeking to include clauses in future debt contracts that will allow borrowers to suspend debt servicing commitments in the event of a climate shock. Meanwhile, Rwanda is set to become the first African country to benefit from a $40bn Resilience and Sustainability trust fund set up by the IMF to help countries deal with the impact of climate change. A $310m staff-level agreement reached with the IMF will enable the Rwandan government to integrate climate-related considerations into its overall fiscal reforms. The Rwandan franc has contracted by about 5% in the past year to RWF 1065 per dollar, against a backdrop of inflation soaring to 23.9% this year amid continued dependence on Russian wheat and fertilizer. A combination of the country’s economic reforms and an agreed IMF climate change related support programme could be a long-term boost for the currency. Naira weakens as Nigeria considers debt restructuring The Naira continued its slide against the dollar this week, trading at 734 from 722 at last week’s close, as Nigeria’s government said it was considering options to restructure its debt. Finance Minister Zainab Ahmed said the country has appointed a consultant to look at ways to ease its debt burden, such as extending repayment periods, according to Bloomberg. Nigeria’s oil output continues to decline amid rising oil theft and vandalism, with the country now Africa’s fourth biggest crude producer behind Angola, Libya and Algeria, having started the year as the continent’s largest. That is piling further pressure on the Naira given that oil revenues are by far the biggest source of FX for the central bank. We expect further depreciation in the unofficial market in the short term as demand pressures continue to weigh heavily on the local currency. Cedi touches new low amid record 37% inflation The Cedi depreciated against the dollar again this week, trading at 10.58 from 10.45 at last week’s close, having briefly touched a record low of 10.63 on Tuesday. Annual inflation hit a record high 37.2% in September, up from 33.9% in August. Ghana’s interest rate is currently at 24.5%, its highest level since 2017 following last week’s 250 basis point hike. Given that inflation is being driven mainly by the supply side, the bank’s rate hikes are not proving as effective in curbing rising prices. Fitch Ratings has warned that a sovereign debt default is a real possibility, with any kind of domestic restructuring likely to severely impact the local banking sector. Against that backdrop, we [AZA Finance] expect the Cedi to continue weakening towards the 11 level in the near term. Watch the latest episode of BizTech below: Risk-off drives Rand lower as planned power cuts ease The Rand weakened against the dollar, trading at 18.18 from 18.04 at Friday’s close as risk-on sentiment of last week was snuffed out amid concerns about global growth and an escalation of Russia’s war in Ukraine. On the domestic front, planned power cuts are expected to ease this week. A workers’ strike at freight company Transnet has seen South African coal exports slow to the lowest level in a year, causing coal prices to jump higher. Europe’s increased dependence on South African coal amid the ongoing energy crisis is likely to provide some support to the Rand in the months ahead. For the near term, we expect the Rand to continue trading in line with global risk sentiment. Egypt Pound at record low as banks limit FX withdrawals The Pound edged to a fresh low against the dollar, trading at 19.69 from 19.66 at last week’s close. Egyptian banks have been taking steps in recent days to limit the withdrawal of foreign currency to protect against a scarcity of dollars in the country. The central bank is also considering allowing non-deliverable forwards so companies and investors can hedge exposure to large swings in the Pound. Meantime, annual inflation climbed to 15% in September from 14.6% a month earlier, pushed higher by rising food and transportation costs. We expect the Pound to weaken further in the coming days, although Egypt’s hosting of next month’s UN climate change conference COP 27 could help drive FX inflows with increased visitors. Shilling slides as Kenya reserves hit 7-year low The Shilling depreciated against the dollar, trading at 120.80/121.00 from 120.70/120.90 at last week’s close—just shy of a record low—due to increased dollar demand by importers in the oil, energy and manufacturing sectors. Economic growth slowed for a fourth consecutive quarter, hitting 5.2% in Q2 of the financial year from 6.8% in the previous three-month period as election-related uncertainty and the worst drought in 40 years weighed on activity. To support the Shilling, the central bank sold an unspecified amount of dollars. Kenya’s FX reserves fell to $7.3bn last week from $7.4bn a week earlier—the lowest level in seven years—amid lower foreign funding, faster import growth and a slowdown in remittances. We expect the Shilling to stabilise in the coming week as the central bank continues to dip into reserves to cushion against volatility. Ugandan Shilling weakens amid rate hikes The Shilling weakened against the dollar, slipping to 3831 from 3817 at last week’s close. Uganda said it was working with China, the US and Russia to find potential investors to help develop East Africa’s first nuclear power plant, which the government hopes to have operational by 2031. Meantime, Uganda’s purchasing manager’s index climbed to 51.6 in September from 50.5 in August, the strongest level in five months. The central bank said more rate rises could be on the cards following last week’s 100 basis point hike. Uganda’s benchmark interest rate has increased by 350 basis points since June, now at a three-year high of 10%. We expect the Shilling to weaken further in the near term due amid higher import costs. Tanzania outlook raised at Moody’s as exports soar The Shilling appreciated marginally against the dollar, trading at 2331 from 2332 at last week’s close. Moody’s upgraded Tanzania’s credit outlook to positive from stable, affirming its B2 rating, five levels below investment grade, based on lower political risk given the government’s new approach to promoting economic development and engagement with the international community. Tanzanian exports hit $1.4bn during the 12-months to August, a 75% increase on the previous 12-month period. We expect the Shilling to continue strengthening modestly against the dollar in the week ahead. Watch the latest episode of BizTech below: