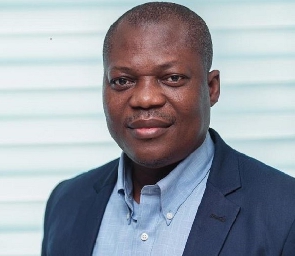

There is a need for the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) to be reformed to accommodate ethical banking and achieve financial inclusion, Prof. John Gatsi, Dean of the University of Cape Coast Business School, has said.

Speaking at the seminar on ethical finance on Islamic finance organised by Islamic Finance Research institute Ghana at the University of Cape Coast for Students on the topic regulatory reforms for ethical finance, Prof. Gatsi explained that the World Bank and IMF have given recognition and acceptance to ethical finance in many countries, including USA, UK, France, Germany, Nigeria., Uganda among others.

He said the issue about ethical finance should be looked at from financial inclusion perspective and not religious though was structured on Islamic law.

He said the slow pace of amending the law to accommodate Islamic finance and banking denies the country of the immense benefits of inclusion and opportunities for choice of financial products.

Prof. Gatsi noted that Act 930 was largely enacted for conventional banks and there was a need to create legal flexibility to accommodate governance structures conducive for Islamic banking.

He said among other things that there were infrastructural support benefits to be derived by the country.

He said Nigeria over the past few years had leveraged on Islamic bonds to construct roads and federal projects.

Prof. Gatsi said section 18(1)(r) seems to grant non-interest banking services but the restrictions and prohibited transactions in section 19 relating to direct participation in agriculture, housing and industrial development would not be in consonance with partnerships, joint ventures and project finance arrangements in Islamic finance.

He explained that access to Islamic financial products, services and instruments had no regard to whether an applicant was a Muslim or not.

“There is no fear about promotion of Islamic religion because it will not arise, rather entrepreneurs and businesses will have alternatives to finance their businesses in socially acceptable and sustainable manner,” he said.

Prof. Gatsi explained that regulatory reforms were only needed in licensing Islamic banks; individuals could enter into various joint ventures and partnerships fostering interest free loans and transactions among themselves.

“Regulations and the law come in when we are talking about Islamic banks for every financial institution which must be licensed and regulated,” he said.

He said the corporate governance design of the conventional banks in section 56 of Act 930 fell short of the two tier corporate governance structures of Islamic banks needed to vet Islamic financial products and instruments.

He advised for broad-based engagement to include leaders of commercial banks, Muslim clerics, Christian leaders, academics and parliament for better appreciation of the principles.

Business News of Saturday, 4 February 2023

Source: ghanaiantimes.com.gh