The Bank of Ghana has stated that banks who were consolidated or had their license revoked were as a matter of fact beyond salvaging.

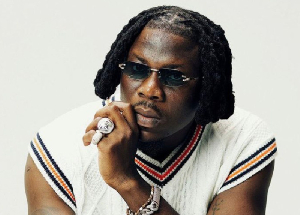

According to the First Deputy Governor of the Bank of Ghana, revoking the licenses of these banks was a tough decision for the Bank of Ghana.

He claims the banking sector cleansing has been justified considering none of the institutions that were consolidated or shutdown challenged his outfit.

“That was a tough decision to take and I strongly believe that if you look at the data we put out there, there was not a single institution that can stand up and say that we were not supposed to be closed and you closed us.”

Dr Opoku-Afari quizzed why government had to continue using 20 million of tax payer’s monies to clear cheques of failed institutions; he called it poor cooperate governance.

“I think it’s important that we understand that the method we used for the clean-up depended on the root cause of the problem. Those institutions have lost their franchise value, some of those institutions if you don’t know, were depending on life support. Meaning for their cheques to be cleared every day, taxpayer’s money from Bank of Ghana, 20 million on average had to be given to them for their cheques to go through clearing and that money will be syphoned out of there, how do you think we will be able to sustain that, to keep that institution alive? So that’s the poor cooperate governance.”

Speaking at Day 2 of the Ghana Industrial Summit Wednesday 11th, 2019, First Deputy Governor hinted that but for the reforms carried out by government, the entire economy would have collapsed.

He noted that as a regulator, measures were taken to protect and strengthen other banks that may have flawed with poor business decisions.

“People keep talking about why didn’t we put those monies into the institutions? Those are not the institutions you can put money in. But there are other institutions that are existing that monies have been put in because they are more strong and they make just a few wrong business decisions. You don’t close those institutions. We don’t put money in those institutions that are leaking fraudulently.”

However, so as not to create disorderly collapse in the economy, fraudulent leakages from banks were apprehended and dealt with.

“What you do for such an institution is dead and gone. You revoke the license, so you rather prevent it from spilling over to affect other institutions.

If the bank of Ghana did not go in there, what would have happened is called a disorderly collapse. If you’re a regulator and you’re left with a choice to protect these institutions and deal with them so you can protect the stronger ones and strengthen them, or you allow them to collapse and collapse the entire economy. That was a tough decision to take," he said.

Business News of Wednesday, 11 September 2019

Source: www.ghanaweb.com