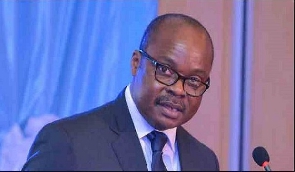

Governor of the Bank of Ghana, Dr. Ernest Addison, has maintained that it was the right decision to revoke the licences of some local banks as their level of insolvency and poor corporate governance structures did not make bail out a good option.

The regulator has been accused by some members of the public for not using discernment in handling the sector reforms, arguing that a bailout strategy could have been a cheaper option to the taxpayer and could have saved a lot of lost jobs rather than collapsing the banks and using over GH¢10 billion to protect depositors’ funds.

In fact, the governor himself has said that only GH¢849 million, representing just 8.4 percent, has been retrieved so far from the loan defaulters and the sale of some assets from the collapsed banks, adding to the argument that the exercise was just a waste of taxpayers’ money.

But Dr. Addison, speaking at the Ghana Association of Bankers annual working luncheon, maintained that a vivid understanding of what led the banks to suffer such fate makes it the right decision to revoke their licenses in order to restore confidence in the sector.

“The question on people’s minds is whether the Bank of Ghana could have used the bail-out money to keep the banks in operation. Ladies and Gentlemen, such reasoning suggests a lack of understanding of the fundamental issues at play. Let me say that the underlying factors that accounted for the resolution of the banks were deeper than liquidity issues.

Here, one can mention very serious infractions, weak governance structures and related-party transactions which rendered those defunct banks insolvent. I will not rehash these issues but rather look forward to the emergence of a stronger and well-capitalized banking sector, and as major stakeholders of the financial sector, we should all commit ourselves to never roll back the gains we have achieved in the industry.

The Bank of Ghana is confident that the actions taken in terms of recapitalization, closure of insolvent banks and widespread regulatory reforms will gradually be bringing back trust and confidence in the Ghanaian banking sector, he said.

He further used the platform to debunk allegations and assertions that the regulator’s actions were politically motivated as some banks which have their owners affiliated to the ruling party and had liquidity challenges were spared by the regulator and given a bailout option, saying those banks were better managed.

“There have also been some assertions that the Bank of Ghana has allowed banks that were not able to raise the minimum capital by the deadline to continue even after the deadline. I am sure you all followed the debate on the need to support indigenous banks which received a favourable response from the Government through the creation of the Ghana Amalgamated Trust [GAT].

The banks that received support from GAT met the qualifying criteria of being better governed and well managed. What is being perceived as discriminatory should rather be seen as a reward for better corporate governance and good management. That was the qualifying criteria. With the exception of the two state-owned banks (ADB and NIB), the private banks that received assistance were assessed and considered better managed than those that had their licenses revoked.

Business News of Thursday, 19 September 2019

Source: thebftonline.com