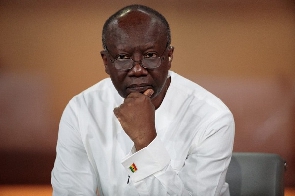

The government still faces a residual Covid-19-induced financing gap of GH¢17.9bn, despite receiving combined funding of US$1.57bn from the International Monetary Fund, World Bank and the Ghana Stabilisation Fund, Finance Minister Ken Ofori-Atta has told Parliament.

To help finance the gap without crowding out the private sector, which itself is reeling from the coronavirus shock, the government has resorted to central bank financing via a GH¢10bn Covid-19 Relief Bond programme, out of which the bank released GH¢5.5bn to the finance ministry on May 15.

Presenting a report to lawmakers in Accra on Thursday on government’s decision to seek extra funds to weather the pandemic, Mr. Ofori-Atta argued that the sustainability of the country’s macroeconomic growth coupled with shortfalls in revenues, additional emergency spending and tight financing conditions necessitated the bond programme.

The emergency financing from the central bank is consistent with the provisions of Section 30 of the Bank of Ghana Act 2002, he noted.

He said preliminary assessments—taking into consideration the revenue shortfall impact, direct health-related spending, additional expenditures including programmed expenditures for the Coronavirus Alleviation Programme, the payment of outstanding government claims to health-related sectors of the economy (National Insurance Trust Fund), and identified government intervention programmes—have put the pandemic-induced fiscal gap at about GH¢21.42bn.

This is made up of a revenue shortfall impact of GH¢15.85bn in addition to COVID-19 related expenses of GH¢5.57bn.

The coupon rate for the Covid-19 Relief Bond is pegged to the monetary policy rate, currently at 14.5 percent, and the bond has a 10-year tenor and a two-year moratorium on both principal and interest payments.

Mr. Ofori-Atta said government will introduce remedial measures to reduce its indebtedness to the central bank. These include revenue mobilisation enhancement measures, an expenditure rationalisation and prioritisation programme, and a strategy to broaden the investor base to access cheaper sources of financing.

A further measure is a policy to revise the primary dealer guidelines and introduce a bond market specialist as a basis for developing the domestic debt market.

Government has so far received a US$1bn IMF Rapid Credit Facility, US$350m World Bank support, and US$219m drawn from the Stabilisation Fund, all aimed at shoring up funds to cushion the economic impact of the virus since March this year.

Work done by the finance ministry and Bank of Ghana on the initial potential impact of the pandemic on various sectors of the economy showed that 2020 real GDP growth will slow down from the projected 6.8 percent to 1.5 percent, with lingering effects on economic activity into 2021 and beyond, Mr. Ofori-Atta said.

To address this, the ministry is developing a three-year Covid-19 Alleviation and Revitalisation of Enterprise Support Programme (The Ghana CARES Programme) to help stabilise and revitalise the economy.

Bond amounts to breach of law

Reacting to the Finance Minister’s report, Minority Leader in Parliament Haruna Iddrisu said the bond programme breached the Bank of Ghana Act, adding that the focus of the Finance Minister should be ensuring a “Ghana beyond borrowing”.

Ranking Member on the Finance Committee Ato Forson said the borrowing of GH¢10bn is unprecedented and requested that further details of the bond should be provided, as he stressed that the minority will continue to ask for accountability.

Click to view details

Business News of Friday, 29 May 2020

Source: thebusiness24online.net