The government of Ghana must remove taxes on petroleum products in the coming weeks, the Chamber of Petroleum Consumers (COPEC-GH) has admonished.

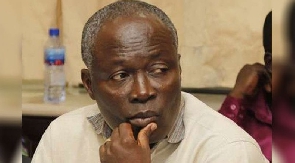

“It is our belief that government will, as a matter of urgency, reduce the tax levels to absorb the increases in prices of crude and products on the world market to forestall any imminent increases in pump prices,” Executive Secretary of COPEC-GH, Duncan Amoah stated on Tuesday October 11.

The call follows a projected hike in petroleum prices across fuel stations in the country due to an increase in crude prices across the globe.

Government announced a reduction in marine gas oil by at least 20%. Cost of aviation fuel was also reduced by 25% earlier in June and the chamber has lauded government’s efforts in reducing the prices of those fuels, adding: “Two reduction efforts give Ghanaians and for that matter the chamber of petroleum consumers, the confidence and an indication of every possibility of government adjusting downwards in same vein, the levels of taxes on petrol and diesel to cushion both private and commercial road users.”

“Government set for revenue purposes in the 2016 budget, export prices of $53/barrel, which at the end of last year was hovering around $43/barrel. This necessitated the introduction and passing of the 2015 Energy Sector Levies Act, leading to an increase in fuel prices by up to 27%.”

He argued that the price stabilisation margin charge on petroleum products also needed to be reviewed to be sensitive and to respond to the changing trends in prices and not be treated as a revenue levy as is currently being applied across the board.

Click to view details

Business News of Tuesday, 11 October 2016

Source: classfmonline.com