Dealers of used electrical appliances in Tema Communities One and Two have expressed dissatisfaction at the high excise duties imposed on imported goods, citing this as a factor in the low level of patronage.

They claimed many taxes were imposed on their goods making clearance cumbersome.

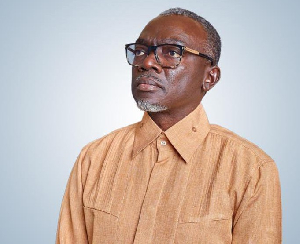

Mr. Frank Okyere, a dealer in used goods, in an interview with Ghana News Agency in Tema said low patronage of goods was due to the current state of the economy and taxes, which also explained the rapidly rising prices of goods.

He mentioned cooking stoves, pressing irons, and washing machines as some of the appliances that had been affected by the taxes.

He said whereas a cooker sold at GHS 800.00 in the past, it was now selling between GH¢1,500.00 and GH¢2,000.00.

Mr. Okyere said since such commercial dealings were capital-intensive, they could not enter into them without having a solid financial foundation.

“As a result, some turn to bank loans and grants for further funding”.

Mr. Nimako Clement another Dealer said the taxes were having a toll on their business and called for assistance.

Mr. Nimako pleaded with the government to lower import duties, since this would benefit numerous dealers who, by hiring some of the younger generation, also contribute to lowering the unemployment rate.

Meanwhile, the Ghana Revenue Authority (GRA), through Mr. Kwabena Apau, Head of Excise, has clarified that the enforcement of tax stamps on new products and textile products at all entry points began on Oct 1, 2023.

According to him, the transitional period runs from October 1, 2023, to December 31, 2023. During this time, all presently marketed products—like sweetened beverages—that were exempted from the tax stamp requirement will need to have them stamped.

He said, “GRA is urging everyone who has inventory of these products to visit the closest GRA office and apply for stamps to be attached to their inventory.”

During a Joint Customs Consultative Committee (JCCC) forum in Tema, Mr Apau made this statement as part of GRA’s efforts to raise client awareness in the port community regarding the application and observance of excise tax stamps.

He stated that on the aforementioned date, newly imported goods that were not previously subject to the tax stamp would be.

All textile products will have a specific stamp called a “textile tax stamp” applied to them to signify that they are compliant and have had all applicable customs and taxes paid.

We began the entrance point enforcement on October 1, he stated.

He continued, “Therefore, all dealers of textile products holding stocks must contact the closest GRA offices and ask that the necessary tax stamps be applied to them.”

Business News of Friday, 20 October 2023

Source: GNA