With two months to the December general elections in Ghana, analysts and development partners have expressed concerns about Ghana’s worsening debt situation as well as government’s spending spree.

According to them, failure to check government’s borrowing appetite and expenditure could lead to a recurrence of the fiscal slippages experienced during the 2012 elections.

The Institute of Statistical, Social and Economic Research (ISSER) has criticised government‘s debt strategy of increasing borrowing on the private capital market, saying the strategy is counterproductive, especially when its management of and spending of borrowed funds is fraught with inefficiencies.

The Institute in its ‘State of the Ghanaian Economy in 2015’ said “Ghana must start to curb the relentless rise of debt; one thing is certain: the longer managers of the economy delay in reckoning with Ghana’s macro-economic problems, the more severe the eventual consequences will be.”

“There is no doubt that a debt crisis looms if corrective measures such as cutting and realigning expenditures are not prioritized; the plain truth with respect to improving the country’s debt position is the need to cut back on spending,” ISSER said in its position on the country’s debt.

According to the Research Institute, at 72 per cent of GDP in 2015, total government debt has remained far above the Sub-Saharan African (SSA) average as a whole and is double its level in 2009, with a rapidly increasing share being owed to the private sector, domestic and external.

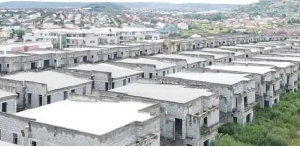

Even though the Institute admits that Ghana’s infrastructural challenge remains a daunting one, it maintains that “it makes little economic sense that despite the fiscal challenges, government has embarked on establishing public tertiary institutions in every region of the country, requiring major public expenditure outlays, even though access to existing public institutions is national and not limited to indigenes of any region.”

This challenge implies that Ghana must undertake a serious prioritization of its public finances, ISSER said.

The Executive Board of the International Monetary Fund (IMF) in its report issued on September 28 also warned against government’s frequent resort to the international capital market for finance.

“The authorities will need to remain cautious in accessing external market financing with due consideration to costs and debt sustainability,” the Fund’s Executive Board said.

The Fund further pointed out that “more work is needed to reduce risks to the economy, the financial sector, and the government budget from their underperformance.”

Government has taken to raising capital internationally to repay maturing debts and to undertake infrastructure projects.

Ghana’s second $750million Eurobond issued last September at a yield of 9.25 per cent for a maturity of 5 years was described by analysts as too costly. Government’s unbridled appetite for borrowing has continued to grow as the Finance Minister, Mr Seth Terkper has recently been targeting Ghanaians in the Diaspora to raise bonds from them.

Ghana’s total public debt grew from GH¢100.2billion in December 2015 (representing 71.6% of GDP) to about GH¢105.1billion by the end of May 2016. The debt has since increased to GH¢108.9billion.

Business News of Thursday, 6 October 2016

Source: thefinderonline.com