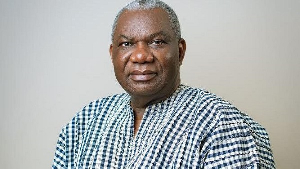

The country’s current economic hardship is the consequence of over 30 years profligacy and successive mismanagement of this economy by various governments, Frank Adu Jnr., Managing Director of CAL Bank, has said.

“For the past 30 years have you seen anything some government has done that will benefit you and your children going forward? The country has been in a slumber for more than 30 years and we always run to the International Monetary Fund (IMF). Why should we do so? It is because of the indiscipline, profligacy and the successive mismanagement of this economy,” he said.

Since 1990, Ghana has had a significant budget deficit, with the highest of 12.1 percent of GDP recorded in 2012. This was as a result of a surge in central government’s spending which increased to 34.5 percent of Gross Domestic Product (GDP), though government revenues amounted to 16.1 percent of GDP for the year.

The 2012 budget deficit of 12.1percent of GDP was almost double the budget deficit of 6.5percent in 2008, notwithstanding the fact that Ghana enjoyed more favourable economic circumstances in 2012.

With the debt-to-GDP ratio, the country recorded a debt-to-GDP of 55.64 percent of the country's GDP in 2013. The debt-to-GDP in Ghana averaged 61.73 percent from 1990 until 2013, reaching an all time high of 125.40 percent in 2000 and a record low of 26.20 percent in 2006.

Currently, Ghana’s debt-to-GDP ratio currently stands at 60.8 percent. A high debt-to-GDP ratio indicates an economy that is unable to produce and sell sufficient goods and services to pay back debts -- and therefore incurs further debt.

By standards of the International Monetary Fund (IMF), low-income economies whose debt-to-GDP ratio exceeds 60 percent face serious risks of falling into a deeper economic mess.

The uncontrolled borrowing has thus led to several governments going to the IMF for support, with the most recent one being the US$940million signed by the government this month that is awaiting approval from executive management of the IMF.

Ghana successfully issued its third Eurobond in September last year, which raised US$1billion. With a 12-year maturity period, the coupon came at 8.1percent and was used to fund capital expenditure in the 2014 budget; counterpart funding for pipeline projects; and refinancing domestic and external debt.

In 2013 Ghana successfully raised US$1billion from the international market in the second issue, which was heavily oversubscribed. It raised US$750million in cash and US$250million in a buy-back of the 2007 issue.

Parliament, a week ago, approved the Finance Ministry’s request to raise another US$1billion Eurobond for refinancing 2017 maturing Eurobond as well as to provide additional capital expenditure as spelt out in the 2015 budget, just six months after the successful issuance of the country’s third Eurobond in less than a decade.

From the domestic market alone, the government plans to borrow twice as much as it borrowed between January and June last year, and all these funds including financing from external sources will be used to pay interest on debt accumulated over the past decade.

This excessive borrowing by government has led to high interest rates and crowding out the private sector -- starving them of finance and curtailing expansion which could have led to the creation of more jobs.

Mr. Adu noted that the economic situation is so difficult right now that “2015 is going to be a difficult year”, and predicted that Ghana will simply pay more interest on the next US$1billion Eurobond.

“I think that the governor is doing his best, but I think there is a lot of interference and all kinds of pressures. Unfortunately, we have a situation where we think that if we talk to someone in IMF we have got the answer. The IMF hasn’t got the answer,” he noted.

Mr. Adu said: “We have created the problem ourselves and must find how to get out of this morass; instead we run to some white boys in Washington -- are we kidding?”

He said the benefit of an IMF programme is that investors will bring money because there will be some discipline.

“But why should we always be tagged as indisciplined? Is it because the leaders are indisciplined? And this is repeating itself all over Africa. Why is it that we all went to the same schools with these boys, and the mere fact that they sit in Washington or Frankfurt makes them brighter than you? And when they come and speak everybody listens to them, but when you speak nobody listens?” he said.

Business News of Wednesday, 1 April 2015

Source: B&FT