General Manager of MTN Ghana's Mobile Money Limited, Eli Hini, has insisted that the decision to implement a MoMo ID requirement for cash-out transactions was not taken lightly.

According to him, the tough decision was made at a time where the electronic money service was fully aware of the implications, backlash and possible losses from customers and agents who fail to conform to the directive.

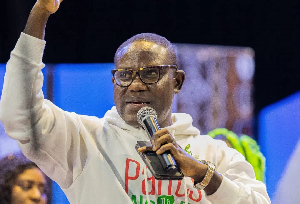

Addressing journalists during a media engagement in Accra last week, Eli Hini said his outfit had to make the bold decision of taking the lead to implement such a measure.

“ID requirement for MoMo transaction was an industry requirement when MoMo was first launched in Ghana but it was not effective at the time so it was pushed aside; but MTN felt the need to take the bold step and lead the way back to that requirement so others will have some learnings from our experience and follow,” Eli Hini stressed.

He continued, “Sometimes people’s behaviour may be just the lack of understanding and so we will reiterate the objectives, what we seek to do, the benefit to them as agents and how it supports the general Mobile Money service delivery and then we believe that once we get to that point when the agent understands and appreciates, he will be willing to support the project and we will all benefit.”

Hini added that currently some additional security features and layers have been added to the electronic money service in order to improve its efficiency and security.

Meanwhile, over 7,000 MoMo agents operating in the country have had their accounts suspended over their failure to comply with the directive implemented by the electronic money company.

Many agents and customers are now required to provide identification before transactions can be carried out.

Business News of Sunday, 18 April 2021

Source: www.ghanaweb.com