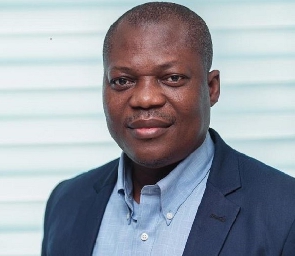

Finance Expert and Dean of Business School at the University of Cape Coast, Professor John Gartchie Gatsi, has clarified that the possibility of maintaining the value of bonds as highlighted as part of the government's debt restructuring is not realistic.

Mr. Gatsi mentioned that "Haircut" only means the loss of value at maturity, either on the principal or the interest of the bond.

"It is very clear to Ghanaians that they are losing money on the interest side because the government proposes interests will not be paid on the bonds in 2023. So, it's very clear they are losing money and there's a haircut," he said.

He reiterated that the maturity period of bonds would be adversely affected, which in turn would imminently wreck the value of existing bonds. According to him, the principle of time value underlines the value of bonds, as he indicated that the value of money is never the same over time.

Giving an explanation of the government's restructuring measures in an interview with Samuel Eshun on e.tv Ghana's "Fact Sheet" show, he noted, "Bonds are spatial instruments because it is not like equity instrument where whatever you derive at the end of the day depends on the company that you invest in. When you come to bonds, it's a commitment or a contract that you have entered into with the bond holders that at maturity, you'd pay principal plus interest or principal and you'll be paying cumulative interest up to maturity."

He also highlighted that negotiation is a crucial factor in bond agreements, which would take a toll on both the maturity and the principal.

He continued, "What happens is that when normally the issuer of the bond cannot pay, he'll come to you to make an arrangement to enter into negotiation, and that negotiation will affect two important things. First, about the maturity, and then the coupon. The coupon, as explained earlier, is the interest on the principal, and remember, there are two interests in bonds. The coupon and the market interest rate. It is the market interest rate that determines the value of the bond, but what we're talking about are the coupons, which are the principal on bonds. So, when the principal is elongated, the maturity period is elongated."

"That will affect the value of the bond, and that will affect what you'll earn at the end of the day because of the time value of money. This explains that the value of money today is not the same value of money tomorrow. So, if the owner says that your value remains the same that is an elusive statement because, in reality, the value of the principal at maturity does not remain the same. The moment the principal or the coupon component is changed, the value will not be the same at future date," Professor Gatsi stressed.

Business News of Thursday, 8 December 2022

Source: etvghana.com