Since taking up his role in August 2017, Dr. Maxwell Opoku-Afari has been instrumental in steering the Bank of Ghana through significant transformations, leveraging his deep insights into monetary policy and economic strategy to enhance financial inclusion and integrate cutting-edge technologies in the financial sector.

Today, we explore his journey, the challenges he's faced, and his strategic vision for the future of Ghana's economy and its integration within the broader digital landscape of Africa. Join us as we gain an unparalleled perspective from one of the leading figures in African economics.

BI Africa: What inspired you to pursue a career in economics and banking, ultimately leading to your current role as the First Deputy Governor of the Bank of Ghana?

I was not entirely sure what career path to take while in school. I was introduced to the subject of economics way back in secondary school and have never left it since then. By the time I entered the University, I was curious enough to explore further, decision-making in an environment of scarcity and constraints. I combined economics with statistics, statistical computing, and politics in my undergraduate studies and then decided to narrow down to applied macroeconometrics in my graduate studies.

I strongly believe that these academic skills, combined with very good-quality operational experience and exposure in my early days at the Bank of Ghana, then with the International Monetary Fund (IMF), and other stints with the UNU-WIDER, etc., better prepared me for my current role as the First Deputy Governor.

BI Africa: As the First Deputy Governor of the Bank of Ghana, what guiding principles or values do you prioritize in your leadership approach?

As the First Deputy Governor, I work to support the governor in discharging the Bank's mandate. I am always guided by strong analytical and evidence-based policymaking. This has guided my oversight role for the departments and functions I oversee. I am also very keen on identifying and helping to develop talents and human capital to provide critical support to the Bank in discharging its mandate.

BI Africa: Can you recount a specific instance where you successfully navigated challenges or adversity within the banking sector, demonstrating your resilience and problem-solving skills?

Working as part of the Management team, rolling out the revocation of the first two bank licenses in Ghana was very challenging and tested all our skills, including analytical, balanced judgment, communication, and logistics. But under the guidance of the Governor, we were able to have a seamless exercise that has helped to reposition banks in Ghana as well-capitalized and profitable to support the economy of Ghana.

BI Africa: How do you assess your role at the Bank of Ghana in contributing to the advancement of Ghana's economy and financial sector, particularly in fostering innovation and sustainable development?

My role in that regard could be looked at on two levels: one will be based on my role as a member of staff of the Bank of Ghana long before I became a Deputy Governor, and then secondly as the current First Deputy Governor.

First, I was privileged to have played a vital role under the leadership of the other governors, as far back as 2007, in the establishment of the Ghana Integrated Payment and Settlement Systems (GHIPSS). This was very necessary considering the challenges faced by Ghana's payment landscape then, which was characterised by gross inefficiencies, high transaction costs, and limited accessibility with relatively fewer banks and SDIs than what we have today. This presented a huge hindrance to the smooth flow of financial transactions nationwide.

Coming into office as the First Deputy Governor with oversight responsibilities for Payment Systems (and, of course, other key departments), I had yet another opportunity to help enhance the capabilities of GHIPSS to fulfil its goals. To that end, a number of initiatives have been successfully implemented under the leadership of the Governor, the most notable of which are payment interoperability, GH-QR Code and GhanaPay Mobile Money.

We also envisioned that the success of GHIPSS in optimally benefitting Ghanaians depended largely on the advancement of the Fintech Sector. Several key reforms were therefore embarked on by the Governor, myself and the second Deputy Governor. For example, we ensured the passage of the Payment Systems and Services Act, 2019 (Act 987), followed by the establishment of the FinTech and Innovation Office in early 2020.

The aim of FinTech and Innovation is to drive cash-lite, e-payments, and digitization initiatives that align with the government's broader digitalization agenda. The overarching objective of this agenda is to digitize fiscal revenue collection, support a cashless society and improve digital literacy, among others.

Today, the significance of GHIPSS in fostering payment interoperability and facilitating innovations in the payment ecosystem is apparent. More remarkable is how the GHIPSS platform compliments the FinTech ecosystem in transforming financial service delivery and advancing the financial inclusion agenda of the Government. Apart from attaining a financial inclusion index of 96% (Demand-Side Survey Report, 2021), the impact of these initiatives on socio-economic lives of Ghanaians is also evident in access to collateral-free digital loans to the lowest segments of the population (street vendors, market women, etc.).

According to the data, a total of 14.22 million collateral-free loans, valued at GHS 7.10 billion (or USD 582 million), was disbursed to individuals and SMEs in 2023 through their mobile phones. The same can be said of increased access to remittance and other financial services such as insurance, with the data also showing that inward remittance terminated through mobile money wallets increased from GHS 11.38 billion in 2022 to GHS28.32 billion in 2023 (representing a 149 per cent increase), with a significant portion of this received through mobile phone in the comfort of customers’ homes and workplaces.

BI Africa: Considering the theme of the 3i Africa Summit, how do you anticipate the outcomes of the event contributing to the Bank of Ghana's objectives in advancing digital economic potential across the continent?

The primary objective of the 3i Africa Summit is to highlight the potential of African FinTech and digital economies, aiming to inspire increased investment in the sector to amplify its impact on the continent's economic development and growth. This summit serves as a platform for stakeholders, including policymakers, investors, and innovators, to come together and address critical challenges hindering the growth of the FinTech sector, particularly in the realm of policies and regulations.

By collaborating, these stakeholders will co-create initiatives to overcome these obstacles and accelerate the expansion of the FinTech industry. Ultimately, the overarching goal is to foster positive change, sustainable development, and prosperity throughout Africa.

BI Africa: How do you envision the role of the Bank of Ghana in catalyzing the growth of Africa's FinTech and digital economic sector?

The Bank of Ghana has made significant progress in its regulation and promotion of the FinTech Sector and continues to implement NextGen policies to ensure its relevance amidst the ever-changing needs of Ghanaians. Our FinTech regulatory set-up and evolution of policies such as the regulatory sandbox, eCedi and the Business Sans Borders (BSB) initiatives (just to mention a few) have leapfrogged the Bank to one of the centres of excellence. As a result, the Bank has become a hub for visiting by our colleague central banks, especially from the sub-region, to glean insights for enhancing their own regulatory frameworks.

Of course, the 3i Africa Summit itself signifies an invaluable platform for regulators to exchange best practices. Moreover, it offers an opportunity to engage with innovators and investors, ensuring that regulatory reforms are informed by a comprehensive understanding of industry perspectives. This collaborative approach aims to foster a conducive environment for the continued growth and success of the FinTech sector.

BI Africa: How do you anticipate the outcomes of the 3i Africa Summit contributing to the Bank of Ghana's objectives in advancing digital economic potential across the continent?

These can be seen in various ways, including:

- Investment: The deal room and pitch fest are expected to generate concrete investment deals. There should be even more investments in the medium term, considering the expected regulatory reforms that will be pursued based on a comprehensive view of the sector's challenges (including perspectives of capital providers and innovators).

- Regulatory harmony: Regulators will hopefully commit to joint regulatory reforms, including ambitious policies like cross-border payments, FinTech passporting, etc. Concrete initiatives in favour of cross-border payments will have been agreed upon, along with clear implementation plans.

- Excitement in the FinTech ecosystem: Players in the FinTech sector, including start-ups and budding innovators, will have been inspired and encouraged to pursue their dreams, which will ultimately support the growth of the FinTech ecosystem.

Business News of Sunday, 12 May 2024

Source: africa.businessinsider.com

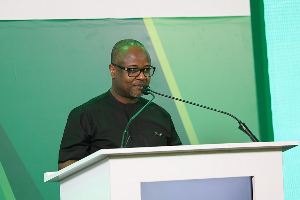

Dr. Maxwell Opoku-Afari speaks on Ghana's economic evolution and digital future

Entertainment