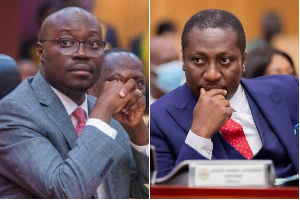

Accra, April 12, GNA - Ghana's economy has shown remarkable strength in the face of record-high crude oil prices and an uncertain world economic order set to unnerve most a developing country, Mr Kwadwo Baah-Wiredu, Minister of Finance and Economic Planning has said. Addressing the Meet-The Press Series in Accra on Wednesday, the Finance Minister said the solid outlook for the economy was a vindication of the prudent manner in which resources had been managed in the last five years.

"The positive picture of our economy is also reflected by the findings of various surveys and studies by reputable international authorities that have painted Ghana as an attractive investment destination."

He indicated that it was this confidence which the Government derived from the state of the economy that had made it possible to invest in human cantered projects including the recent tax relief for all workers, employment creating venture capital scheme, abolishing of basic school fees and the introduction of feeding programmes in basic schools as well as the abolishing of tax on the minimum wage among other things.

Mr Baah-Wiredu admitted that though the fiscal out turn for 2005 indicated that the 2005 Budget performance was not good, the country did not only achieved the main fiscal targets and balances but also exceeded some of them.

"Overall budget balance showed a deficit of 2.1 per cent of GDP against the projected deficit of 2.2 per cent," he said adding, "domestic primary balance recorded a surplus of 3.4 per cent of GDP against the budget target 2.5 per cent."

The Finance Minister said net domestic financing of the budget showed a repayment of 1,574 billion cedis, which was higher than the budget repayment target of 996.2 billion cedis.

"Government was thus able to reduce domestic debt by 1,574 billion cedis, which is 578.2 billion cedis more than the budget target." On the receipts and payments side, total revenue and grants were 28.256 billion cedis representing 29.1 per cent of GDP and over 96 per cent of budget target. Total payments fixed lower than the budget target of 35,801 billion cedis by 872 billion cedis.

Provisional figures indicated that a total of 938.9 billion cedis was paid into the District Assemblies' Common Fund while payments into the Ghana Education Trust Fund (GETFund) were also transferred on schedule with total transfers amounting to 980.2 billion cedis. "In addition to the current payments for 2005, a total amount of 97 billion cedis was transferred to the Common Fund and the GETFund in respect of arrears that were ring-fenced.

"The Road Fund and other petroleum-related funds received a total of 967.3 billion cedis, with the former receiving 926.9 billion cedis."

On the external sector, Mr Baah-Wiredu said the current macroeconomic statistics reflected major policy reforms which spoke for themselves with the economy showing significant resilience despite the deterioration in the terms of trade due to high oil prices.

He noted that at the end of last year the external sector remained viable with gross international reserves at 1.874 billion dollars; enough to provide for about 3.7 months import cover.

Mr Baah Wiredu said the external payments position had grown increasingly favourable and had been able to withstand the hikes in oil prices on the international oil market.

He said the improved economic conditions should serve to underpin a positive outlook, moving forward to accelerated growth based on the investment strategy and reforms underlying the Growth and Poverty Reduction Strategy II (GPRS II).

He said it was expected that with the efficient use of the fiscal space created by debt relief, GDP growth could be raised into the range of seven per cent to eight per cent per annum needed to achieve the MDGs.

He said the debt relief would enhance Ghana's resource requirements for the MDGs, stressing that the resources would be used to further develop the realization of the development objectives by increasing public investment and providing for key poverty sectors.

Business News of Wednesday, 12 April 2006

Source: GNA