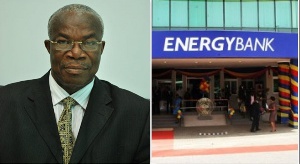

Energy Commercial Bank on Tuesday launched its Initial Public Offering (IPO) to raise GH¢340 million from the Ghanaian investing public as the lender prepares to meet the Regulator’s new threshold for capital requirements. The offer for the subscription of over 261 million new shares at GH¢1.30 per share would run for 30 days.

The offer is geared towards meeting the Bank of Ghana’s directive of a minimum stated capital of GH¢400 million by December 31, 2018.

The Bank, which is currently wholly owned by Nigerian entities, has chosen to recapitalise through a public offer to give individual Ghanaians and institutions the opportunity to participate in its future dream.

It is expected that after the IPO, the Board would be reconstituted to reflect the composition of shareholding.

“The Bank will endeavour to protect depositors and shareholders’ funds and improve on returns on investment, strive to attain job security and improved staff conditions of service and be mindful of its tax obligations,” Mr David Adom, the Acting Board Chairman of the Bank, said at the launch.

Mrs Christiana Olaoye, the Managing Director and Chief Executive Officer of Energy Commercial Bank, said the launch of the IPO was a confirmation of the confidence in the Ghanaian economy.

She said the Bank, since the beginning of operations in February 2011, had exhibited prudent operational, audit and risk management practices in line with the Bank of Ghana’s strict policies.

Mrs Olaoye said the Bank would continue to remain disciplined and focused, conforming to all banking operational processes and procedures and entrenching the good practices in all facets of operation.

Mrs Olaoye said becoming a Public Limited Liability Company would raise investor confidence in the Energy Commercial Bank brand and position it for opportunities and rapid growth.

“We believe that Energy Commercial Bank’s IPO will have a great impact on the Ghanaian economy and expand the financial inclusion agenda by the Government,” she said.

The IPO is also expected to help expand the Bank’s business so as to deliver superior value and customer-centric services.

“We plan to expand our reach between 2019 and 2022 and would not relent in our efforts in doing this by performing consistently in the coming years in order to maximise returns to shareholders.”

In a speech read on his behalf, the Governor of the Bank of Ghana, Dr Ernest Addison, expressed the hope that the IPO would offer an opportunity for the Energy Commercial Bank to raise the needed economic capital for its operations.

There were also messages from the Securities and Exchange Commission and the Ghana Stock Exchange.

Energy Commercial Bank presently operates 12 branches in Ghana - five in Accra, three in Kumasi, and the rest in Tema, Takoradi and Tamale.

Business News of Tuesday, 2 October 2018

Source: thepublisheronline.com

Energy Commercial Bank launches IPO to raise GH¢340 million

Entertainment