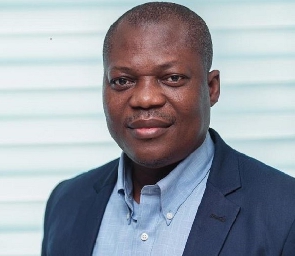

Dean for the University of Cape Coast Business School (UCCBS), Professor John Gatsi has said the announcement on the external debt payment for an International Monetary Fund (IMF) loan places the country in bad light for future loans.

Ghana has announced a suspension of all debt service payments under certain categories of external debt, pending an orderly restructuring of the affected obligations.

The suspension, according to a press statement by the Finance Ministry, will include the payments on Eurobonds; commercial term loans; and on most of the country’s bilateral debt.

According to the ministry, the suspension is an interim emergency measure pending future agreements with all relevant creditors.

Commenting on the announcement on Starr Today with Joshua Kodjo Mensah Monday, Mr. Gatsi indicated that the government’s difficult situation is self-inflicted.

He further added that the government’s predicaments on various debt restructuring were completely avoidable.

“We risk further downgrades but the question is a downgrade to where because we are already in junk status. If you are downgraded deeper it doesn’t mean much to you because you are not going to the debt market now. It is when you go later that you get the backlash as someone who does not keep a covenant. We may give you money but after some time you will come back and say you cannot pay."

“So that is the risk awaiting us as we journey along even though I know that further downgrade does not mean much but it will catch up with us at a future date,” Mr. Gatsi explained.

He said the government had every opportunity to avoid the current situation it finds itself in but failed to recognize it.

“We had every opportunity to borrow according to the revenue size of the country. We had every opportunity to manage our debts well and we had every opportunity not to use COVID to overborrow. We had every opportunity not to use the COVID year to borrow excessively for elections. So we had every opportunity to manage our finances prudently but we chose not to do that and that is what has landed us in this situation.”

Business News of Tuesday, 20 December 2022

Source: thebftonline.com

External debt payment: Government’s future credit worthiness at risk – Prof. Gatsi

Entertainment