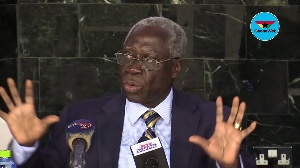

The former Senior Minister Yaw Osafo-Maafo justified the government's decision to borrow GH¢12.7 billion to pay off affected depositors in the banking sector.

He said: “…there has been a lot of hues and cry about the government arranged to borrow some 9.6billion Ghana Cedis to support those banks who failed to make them operational; was it right or not? People are debating. To me, it is not debatable.”

“There is a law that governs the establishment of banks and there’s an authority that provides a license for people to establish banks, and that authority is the Central Bank. So when the Central Bank gives license to Company A to act as a bank, it means they can take deposits of the public…. The public doesn’t know the rules and regulations that go into granting a license…," he added.

Read the full story originally published on November 20, 2018, by GhanaWeb

Senior Minister Yaw Osafo Marfo has justified the government’s decision to borrow some GHC12.7 billion to support banks that failed in order to pay off affected depositors.

He explained that the government had no choice in the matter since it was the duty of the Central Bank; Bank of Ghana to issue licenses to legitimate companies or firms to accept deposits of clients.

Mr. Osafo Marfo stressed that the decision was not debatable because the situation imploded as a result of a lack of accountability.

“…there has been a lot of hue and cry about the government arranged to borrow some 9.6billion Ghana Cedis to support those banks who failed to make them operational; was it right or not? People are debating. To me, it is not debatable.” He told some finance professionals during a workshop on Public Financial Management organised by Trust Consult at

“There is a law that governs the establishment of banks and there’s an authority that provides license for people to establish banks, and that authority is the Central Bank. So when the Central Bank gives license to Company A to act as a bank, it means they can take deposit of the public…. The public doesn’t know the rules and regulations that goes into granting a license…

Once somebody announces that I’m Bank XYZ it is assumed that the bank of Ghana who granted the license would have taken them through the rigmarole of the law and therefore the depositor is protected to put his money there..” he indicated.

The Former Finance Minister under the Kufuor regime noted that the problems of the various banks with issues would have been detected long ago if supervision was top notch. He stressed that government’s choice to protect the depositors was the right call since they had three years to prevent the outcome.

“..Government’s choice is to protect the depositor, and I don’t think the government has a choice. What’s your choice, that you did not supervise properly; did not detect something which you should have done three years ago… and some innocent man whose sweat and money is been put there should suffer as a result of it, the answer is no!”, he added.

Background

Government intervened with GH¢12.7 billion of public funds, made up of a GH¢8 billion bond issued by the Ministry of Finance, and GH¢4.7 billion of liquidity support from the Bank of Ghana, to be injected into the seven banks that failed.

The Bank of Ghana collapsed five banks into a Consolidated Bank of Ghana Limited citing insolvency after investigations by the Central Bank.

The banks were BEIGE, Sovereign, Construction, UniBank, and Royal Bank.

Watch the latest episode of BizTech below:

Click to view details

Business News of Monday, 21 November 2022

Source: www.ghanaweb.com