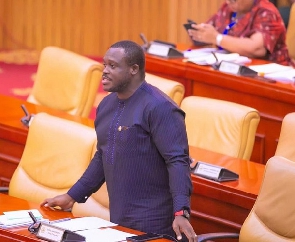

The Member of Parliament for Ningo Prampram, Sam Nartey George, noted that the E-Levy was a "ponzi scheme".

According to him the tax allows same amounts to be taxed multiple times.

In a tweet he said, "The more I process the e-Levy, the angrier I get. It is a complete rip off. It is a taxation ponzi scheme designed to tax d same value of money multiple times. It is plain government thievery & I cannot vote to approve a budget that has that levy included. No!.”

Read the full story originally published on November 21, 2021 by 3news

Member of Parliament for Ningo Prampram, Samuel Nartey George, has said the proposed E-levy in the yet-to-be approved 2022 budget statement is a rip off.

He described it as a ponzi scheme intended to tax the same value of money multiple times.

In a tweet, he said “The more I process the e-Levy, the angrier I get. It is a complete rip off. It is a taxation ponzi scheme designed to tax d same value of money multiple times. It is plain government thievery & I cannot vote to approve a budget that has that levy included. No!”

Minority leader, Haruna Iddrisu, has also said the E-levy is a disincentive to the growth of digital economy.

To that end, he said, the Minority will not support it.

Speaking at a post-budget workshop in Ho on Saturday, November 20, he said “Mr Speaker, understandably, we see that the Minister of Finance seeks to introduce some measures including the now popularly declared e-levy or digital levy as some have quite named it.

“Mr Speaker, our concern is whether the e-levy itself is not and will not be a disincentive to the growth of digital economy in our country. We are convinced that the e-levy may as well even be a disincentive to investment and a disincentive to private sector development in our country. We in the minority may not and will not support government with the introduction of that particular e-levy . We are unable to build a national consensus on that particular matter.”

Finance Minister Ken Ofori-Atta announced a new levy to be charged by government in 2022 on all electronic transactions to widen the tax net and rope in the informal sector.

“It is becoming clear there exists enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the ‘informal economy’,” Mr Ofori-Atta observed on Wednesday, November 17 as he presented the 2022 budget statement in Parliament.

“After considerable deliberations, government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector. This shall be known as the ‘Electronic Transaction Levy or E-Levy’.”

He explained that the new E-levy will be a 1.75 per cent charge on all electronic transactions covering mobile money payments, bank transfers, merchant payments and inward remittances to be borne by the sender except inward remittances, which will be borne by the recipient.

This will, however, not affect transactions that add up to GH¢100 pr less per day.

“A portion of the proceeds from the E-Levy will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others.”

This new levy is scheduled to start Saturday, January 1, 2022.

In 2020, the total value of transactions was estimated to be over GH¢500 million with mobile money subscribers and users growing by 16 percent in 2019.

According to a Bank of Ghana report, Ghana saw an increase of over 120 percent in the value of digital transactions between February 2020 and February 2021 compared to 44 percent for the period February 2019 to February 2020 due to the convenience they offer.

This was definitely heightened by the advent of COVID-19 especially during the lockdown.

Watch the latest episode of BizTech below:

Click to view details

Business News of Monday, 21 November 2022

Source: www.ghanaweb.com