In 1947, plans to establish a national bank with central banking functions was formed in the then Gold Coast. Known today as GCB Bank, the financial institution is arguably the oldest indigenous bank in Ghana.

Its formation was on the back of proposals made from some leading politicians in the Gold Coast.

Two years afterwards in 1949, a select committee of the Legislative Assembly was appointed to investigate the establishment of a national bank with purely central banking functions.

In 1951, the government appointed Sir Cecil Trevor to examine the question of setting up a national bank on commercial lines to finance development projects and to act as a reserve bank that will provide clearing house services.

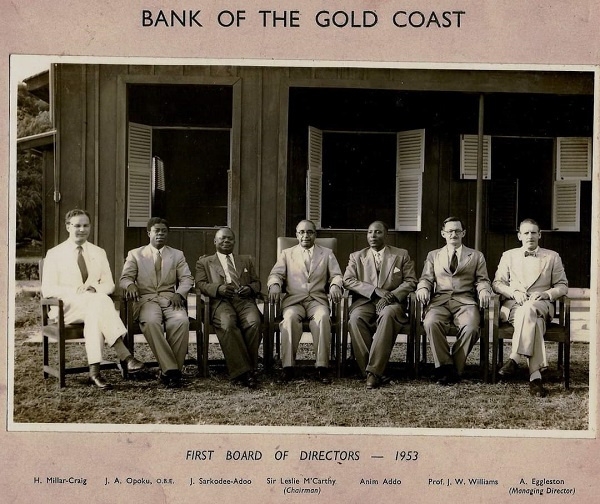

Based on his recommendation, a state-owned commercial bank was established in 1952 under the Bank of the Gold Coast Ordinance. The new Bank, which was named Bank of the Gold Coast, is now GCB Bank, which officially commenced operations in 1953.

By that very year, Alfred Engleston was appointed by the government to serve as head of the Bank of the Gold Coast. Shortly after its establishment, the Bank was split into two sections, namely; Bank of Ghana, which operated as a bank of issue and was to be developed into a complete central bank.

The other was Ghana Commercial Bank, which was to be developed into the largest commercial bank with a monopoly on the accounts of public corporations.

At the start of GBC Banks' operations, it had 27 employees in its first branch, with the primary focus on serving Ghanaian traders, farmers, and business people who could not obtain financing from expatriate banks at the time.

Some four months after Ghana gained independence in March 1957, Alfred Engleston was appointed as the first Governor of the Bank of Ghana. Under his reign, the BoG took over the management of the currency and in July 1958, issued its first national currency - the cedi - to replace the old West African currency notes.

In line with Ghana’s independence, the Bank of the Gold Coast was re-branded to Ghana Commercial Bank, assuming the role and functions of government bankers, while taking over the finance of most government departments and public corporations set up at the time.

Although the Bank of Ghana was wholly-owned by the Government of Ghana, its shares were listed on the Ghana Stock Exchange in 1996 after government's shareholding stood at 51.17 percent.

At the present, government ownership of Ghana Commercial Bank stands at 21.36 percent, while institutional and individual holding adds up to 78.64 percent, according to the Bank of Ghana.

Between 2013 and 2014, Ghana Commercial Bank rebranded itself as GCB Bank Limited. It currently serves the banking needs of large corporations, parastatal companies, small and medium enterprises as well as individuals.

Over the years, the Bank has grown from just one branch in the 1950s to about 150 branches and some 11 agencies operating throughout the country.

This article was first published by GhanaWeb on Saturday August 5, 2023

MA/AE

Watch the latest edition of BizTech below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Click here to follow the GhanaWeb Business WhatsApp channel

Business News of Wednesday, 11 September 2024

Source: www.ghanaweb.com